In the dynamic landscape of Banking, Financial Services, and Insurance (BFSI), where assets worth trillions are managed globally, the back office plays a pivotal role in ensuring seamless operations. The BFSI industry is valued at approximately USD 124 trillion, showcasing its sheer magnitude and complexity. As we navigate through the details of this sector, understanding the significance of the back office becomes imperative. Beyond its traditional support functions, the back office serves as the backbone, addressing challenges like regulatory compliance and customer service. In this era of digital transformation, where customer expectations evolve rapidly, optimizing back-office processes becomes the linchpin for success. This blog delves into the role of the back office in BFSI, exploring solutions through outsourcing, market trends, and the transformative journey of this industry. Let’s embark on a journey to unlock the secrets of BFSI success by unlocking the potential of the back office.

Transform your BFSI operations with Venturesathi Services. From customer support to regulatory compliance, we’ve got you covered. Explore our services today!

Challenges Faced by BFSI Players

1. Compliance Management

Compliance management stands out as a paramount challenge in the BFSI industry, especially with the increasing prevalence of online models. The shift to digital platforms introduces inherent risks, where customers are susceptible to potential fraud and duplicitous activities. According to a report from Cybersecurity Ventures, global cybercrime costs are projected to reach $10.5 trillion by 2025, emphasizing the critical nature of compliance in mitigating these risks. Managing these risks becomes a delicate balancing act for BFSI players.

The complex web of regulatory compliances adds another layer of challenge. According to a study by Thomson Reuters, the financial industry spends an average of $120 billion annually on compliance-related activities, showcasing the financial burden associated with adherence to regulations. Unlike the traditional offline model, the online space demands stringent measures to curb fraudulent activities and ensure the security of user data. The struggle to align with these regulatory requirements while maintaining seamless operations poses a significant hurdle for BFSI entities.

2. Customer Education

The digital transition in BFSI necessitates a paradigm shift in customer education. Users engaging with banking and insurance services in the digital space require comprehensive training to navigate the platforms effectively. According to a survey by Accenture, 73% of customers believe it is essential for banks to ensure they are digitally savvy. The absence of a robust support system for instant issue resolution impacts overall customer experience and, subsequently, business growth.

Bridging the gap between traditional and digital users becomes imperative, demanding BFSI companies invest in educational initiatives. According to PwC, 79% of banking CEOs are concerned about the speed of technological change, highlighting the urgency for enhanced customer education. The success of digital transformation hinges on elevating customer awareness and ensuring a smooth transition, underscoring the crucial link between user education, customer satisfaction, and sustainable business growth.

Curious about outsourced accounting solutions in banking? Dive into our blog for expert insights on leveraging outsourcing for precision and compliance.

The Need for Back Office Process Outsourcing

1. Digital Transformation in BFSI

The BFSI industry is currently navigating a transformative phase marked by the adoption of digital technologies. The debate between a hybrid model, offering both online and offline services, and a purely digital model reflects the industry’s attempt to cater to diverse customer preferences. The 3G and 4G network penetration has empowered leading BFSI players, enabling them to reach millions of users instantly. In this digital evolution, the need for additional support becomes evident. While the hybrid model expands market share, the shift towards a robust digital model requires extensive support to manage challenges effectively.

2. How Back Office Outsourcing Addresses Challenges

a. Enhancing Customer Support

Back-office process outsourcing services offer BFSI companies a strategic solution to amplify customer support. With services such as live chat support and email support, users, especially those new to Internet banking, can receive instant assistance, contributing to a seamless user experience.

b. Managing Compliance and Regulatory Requirements

Compliance management is a daunting task in the online BFSI landscape. Back-office outsourcing providers specialize in navigating regulatory complexities, ensuring that BFSI players adhere to stringent requirements. This not only mitigates risks but also streamlines operations.

c. Efficient Data Management

The BFSI sector relies heavily on accurate and secure data management. Back-office outsourcing services, equipped with advanced data management solutions, assist in maintaining KYC documents, data digitization, and document management. This ensures that customer data is handled efficiently and securely, meeting industry standards and regulations. Overall, back-office outsourcing becomes a cornerstone in addressing the multifaceted challenges encountered during the digital transformation journey of BFSI companies.

Discover how contact centers revolutionize customer service in BFSI. Dive into our blog for insights on optimizing customer interactions.

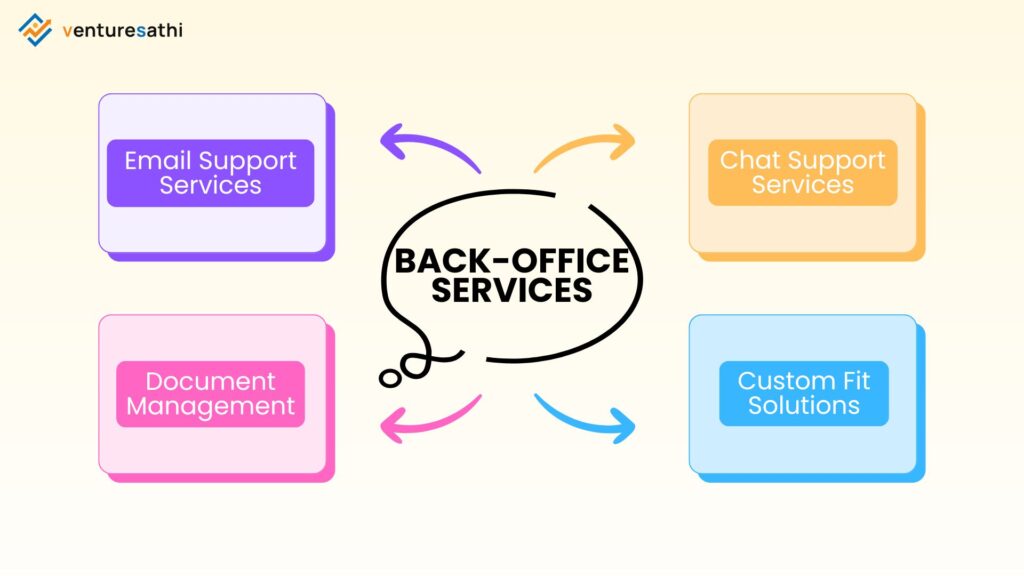

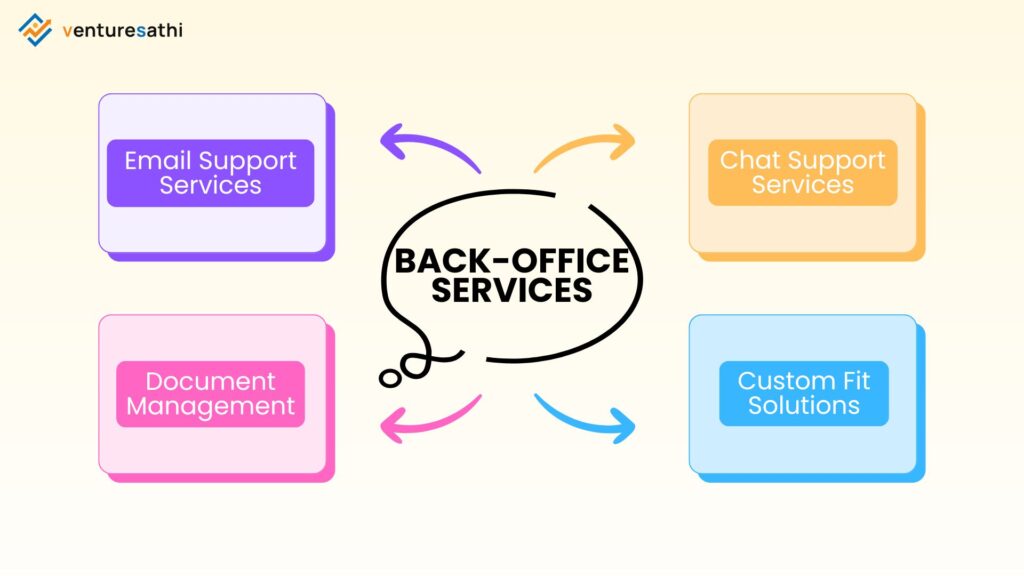

Back Office Services for BFSI Success

1. Email Support Services

In the BFSI sector, where trust and real-time communication are paramount, email support services play a crucial role. Offering real-time customer interaction through emails ensures that clients can access quality support even during busy schedules or while on the move. This enhances customer satisfaction and builds a foundation of trust, a cornerstone for success in the industry.

2. Document Management Outsourcing

KYC compliance is a pivotal aspect for BFSI players, necessitating meticulous document management. Document management outsourcing services ensure that the KYC documents of every customer are not only securely stored but also efficiently managed. This streamlines the compliance process, reduces risks, and contributes to the overall operational efficiency of the BFSI company.

3. Live Chat Support Services

With the advent of Internet banking, users often seek instant assistance for queries. Live chat support services bridge this gap, providing users, from college students to retired professionals with immediate access to crucial resources. This not only enhances user experience but also contributes to the omnichannel expertise required in the dynamic BFSI landscape.

4. Custom Fit Solutions

a. Collaborating with Outsourcing Service Providers

BFSI companies can now collaborate with back-office process outsourcing service providers to develop custom-fit solutions. This tailored approach ensures that the outsourcing services align with the specific needs of the BFSI company, promoting efficiency and cost-effectiveness.

b. Tailoring Solutions for Diverse Audiences

The BFSI customer base is diverse, encompassing various demographics. Custom-fit solutions address the unique requirements of different customer segments, ensuring that the services provided resonate with the specific needs of college students, key stakeholders in MNCs, or retired professionals. This adaptability is crucial for BFSI’s success in a competitive landscape.

Unlock the secrets of efficient bookkeeping in BFSI. Delve into our blog to learn how outsourcing transforms financial management for banks.

Use Cases for Back Office Outsourcing in BFSI

1. Inbound Customer Chat

In the dynamic BFSI industry, where customer queries can arise at any hour, inbound customer chat services offered through back-office outsourcing ensure round-the-clock support. This timely assistance not only enhances customer satisfaction but also contributes to the establishment of a reliable and responsive brand image, crucial for success in the competitive financial landscape.

2. Outbound Email Support

Outbound email support services play a vital role in managing informational communication from BFSI companies to their clients. Whether it’s updates on financial products, policy changes, or promotional offerings, outsourcing these services ensures effective and targeted communication. This enhances customer engagement and keeps clients informed, fostering a sense of transparency and trust.

3. Data Digitization Services

In the BFSI sector, which deals with vast amounts of data, efficient data digitization services are crucial. Back-office outsourcing facilitates the seamless conversion of data into digital formats. This not only ensures easy accessibility and retrieval of information but also aligns with the industry’s growing emphasis on digitization for streamlined operations.

4. Inbound Email Support

Inbound email support services provide BFSI companies with a structured mechanism to handle customer queries efficiently. Outsourcing this aspect ensures that client emails are promptly addressed, contributing to a positive customer experience. Additionally, it allows BFSI professionals to focus on core competencies while customer inquiries are expertly managed.

5. Live Chat Management

Live chat has become a preferred mode of communication for users in the BFSI sector. Outsourcing live chat management ensures the effective running of these mechanisms. Trained professionals handle real-time customer interactions, addressing queries, guiding users through processes, and fostering a responsive communication channel.

6. KYC Management

KYC compliance is a regulatory necessity in BFSI. Back-office outsourcing provides specialized services for KYC management, streamlining the compliance processes. This includes verification, documentation, and record maintenance, ensuring that BFSI companies adhere to regulatory standards while efficiently managing customer onboarding and interactions.

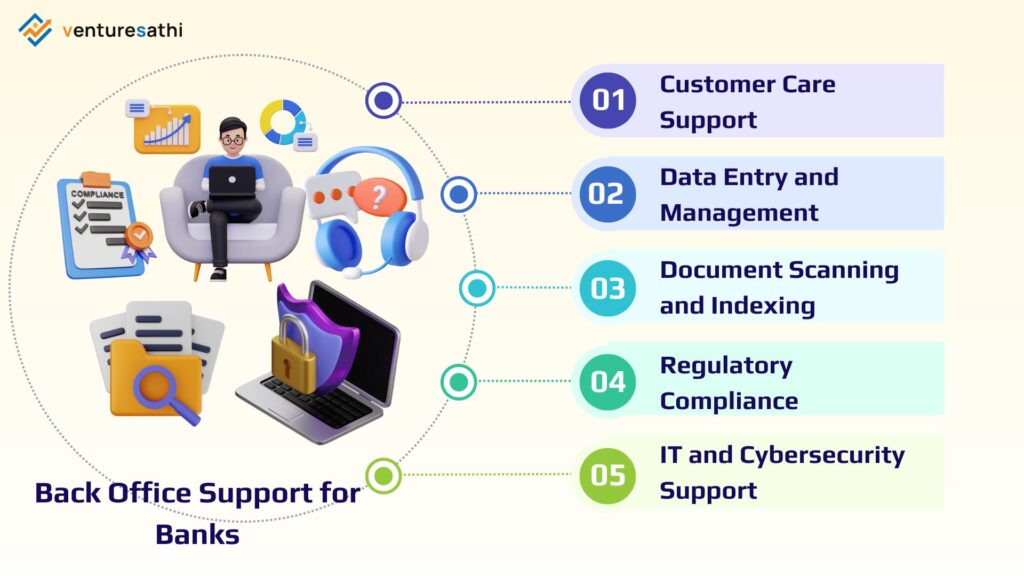

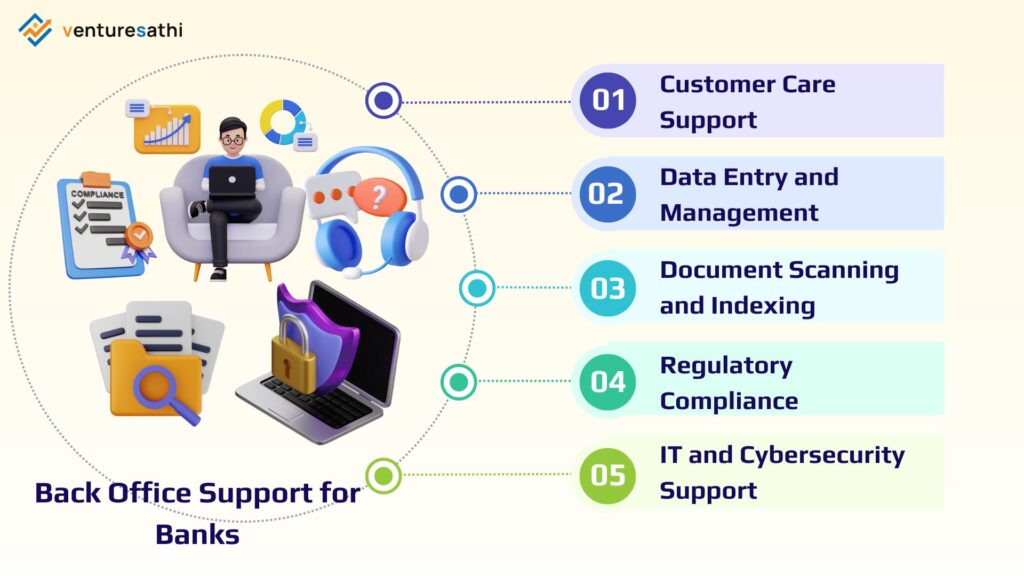

Back Office Support for Banks

1. Customer Care Support

Outsourcing customer care support is a strategic move for banks to ensure a consistent and efficient response to customer inquiries. Trained professionals handle diverse customer queries, enhancing overall customer satisfaction and loyalty.

2. Data Entry and Management

The meticulous task of data entry and management is efficiently handled through outsourcing. This not only reduces the risk of errors but also allows banks to focus on leveraging accurate data for strategic decision-making.

3. Document Scanning and Indexing

Streamlining document scanning and indexing through outsourcing enhances the accessibility and retrieval of crucial information. This is vital for banks dealing with extensive documentation, ensuring compliance and operational efficiency.

4. Regulatory Compliance

Outsourcing regulatory compliance functions enables banks to navigate the complex landscape of banking regulations effectively. External experts stay abreast of regulatory changes, ensuring that the bank’s operations align with legal requirements.

5. IT and Cybersecurity Support

As banks heavily rely on technology, outsourcing IT and cybersecurity support ensures a robust and secure technological infrastructure. This proactive approach safeguards sensitive customer data and prevents potential cyber threats.

Unlock streamlined communication channels for your banking operations with our specialized contact center solutions. Ready to optimize your customer interactions?

Key Benefits of Back Office Support in Banking

Around 77% of retail banks outsource at least one part of their business operations, as per a report from World Retail Banking. Here are some of the benefits of back-office support in banking.

1. Cost-Saving

Back-office support in banking facilitates efficient resource utilization by outsourcing non-core functions such as data entry, document management, and customer support. This strategic allocation of tasks reduces operational costs associated with hiring and training in-house staff. According to a survey by Deloitte, outsourcing non-core functions can lead to cost savings of up to 30%, allowing banks to redirect resources to more critical areas.

2. Focus on Core Aspects

With back-office support handling routine tasks, banks can concentrate on core aspects like innovation, product development, and customer engagement. This shift in focus allows for the pursuit of strategic goals, fostering long-term growth and competitiveness. The Banking Industry Technology Secretariat (BITS) reports that banks focusing on core competencies experience 18% higher revenue growth compared to those spreading resources across various functions.

3. More Flexibility and Agility

Back-office outsourcing provides banks with the flexibility to scale operations based on market demands. This agility enables quick responses to industry changes, ensuring the bank remains adaptive and responsive to customer needs. A study by PwC highlights that 80% of financial institutions believe outsourcing enhances their ability to respond to market dynamics and regulatory changes swiftly.

4. Access to High-End Technology

Outsourcing partners bring high-end technology and digital platforms to the table. Banks benefit from access to cutting-edge solutions without significant capital investments, fostering innovation and staying technologically competitive. Research from McKinsey reveals that banks embracing outsourcing partnerships for technology solutions experience a 15-20% increase in operational efficiency and innovation.

5. Improvement in Service Quality

Back-office support services are often provided by specialized outsourcing partners with expertise in specific areas. Banks can leverage this expertise to enhance service quality, ensuring efficient and professional handling of various tasks. Research by Accenture indicates that 89% of organizations believe outsourcing partners contribute significantly to improving service quality through specialized skills and experience.

Explore our in-depth analysis of contact center solutions for banking. Learn how streamlined communication boosts operational efficiency in the BFSI sector.

Takeaway

Optimizing back-office operations through strategic outsourcing emerges as a pivotal factor in the success of the Banking, Financial Services, and Insurance (BFSI) sector. The challenges faced by BFSI players, from compliance management to customer education, find effective solutions in the form of back-office support services. The need for process outsourcing becomes imperative in the digital transformation era, where hybrid models and additional support play a crucial role. Specific back office services, such as email support, document management outsourcing, and live chat support, prove instrumental in addressing industry-specific challenges. With tangible benefits like cost-saving, improved focus on core aspects, flexibility, access to advanced technology, and enhanced service quality, banks can navigate the dynamic landscape more efficiently.

To embark on this transformative journey, consider partnering with a reliable back-office outsourcing provider. For tailored solutions and insights, contact us today. Elevate your banking operations and embrace a future of enhanced efficiency and customer satisfaction.