The landscape of the Banking, Financial Services, and Insurance (BFSI) sector has undergone a remarkable evolution in recent years, propelled by technological advancements and an ever-growing array of financial products. As this industry navigates through the intricacies of a digital era, it faces both unprecedented opportunities and daunting challenges.

Did you know that the global BFSI market is projected to reach trillions, making it one of the most dynamic and impactful sectors in the world?

In the face of this rapid evolution, BFSI entities find themselves grappling with multifaceted challenges. The specter of fraud looms large, threatening the financial well-being of institutions and their clientele. Simultaneously, technological advancements that promise efficiency and innovation also expose vulnerabilities that need vigilant safeguarding.

Have you ever wondered how financial institutions balance the tightrope between embracing cutting-edge technology and safeguarding against cyber threats?

This backdrop underscores the critical importance of robust customer service in the BFSI sector. It’s not merely a service; it’s a shield against fraud, a bridge to technological progress, and a cornerstone for fostering trust in an industry where every transaction, every piece of data, holds immense significance.

What if customer service could be the linchpin that transforms challenges into opportunities, offering a secure haven in the ever-evolving BFSI landscape?

In the following exploration, we delve into the dynamic world of BFSI, unraveling the challenges it faces and highlighting the pivotal role of customer service in steering this industry toward a secure and customer-centric future. Join us on this journey through the heart of finance, where every interaction matters, and every solution shapes the future.

Ready to revolutionize your BFSI customer service experience? Contact Venturesathi today to discover tailored contact center solutions that drive excellence and elevate customer support to new heights.

Changing Dynamics of Customer Support in BFSI

The landscape of customer support in the BFSI sector is undergoing a profound transformation, marked by a shift from traditional phone-based assistance to a versatile multichannel approach. Institutions, both colossal and nimble, are recalibrating their customer support paradigms to align with the evolving expectations of their clientele.

1. Evolution from Traditional to Multichannel

In the yesteryears, customer support in BFSI primarily revolved around phone-based interactions. Customers dialed helpline numbers seeking assistance, and banks responded through human-operated call centers. However, the winds of change have swept through this conventional model.

Today, the BFSI sector has embraced a multichannel approach, recognizing that customers prefer diverse avenues for seeking assistance. A survey by Accenture found that 49% of banking customers prefer using digital channels for problem resolution, indicating a significant shift away from traditional phone-based support. The rise of social media, the advent of chatbots, and the ubiquity of email have broadened the spectrum of customer interaction. Now, clients can access their accounts securely through blockchain-backed platforms, receiving real-time support via channels beyond the traditional telephone.

2. Adapting to New Customer Support Paradigms

Major institutions such as HDFC, ICICI, and SBI, pillars of the BFSI sector, are at the forefront of adapting to these new customer support paradigms. These financial giants have transcended the limitations of conventional support by incorporating cutting-edge technologies and diversifying communication channels.

HDFC Bank’s implementation of AI-driven chatbots has resulted in a 90% reduction in response time, as reported by their official press release. This showcases the tangible impact of integrating advanced technologies in customer service.

ICICI Bank, in its annual report, highlighted a 15% increase in customer satisfaction after integrating transaction platforms into its customer support ecosystem. The bank ensures that customers using platforms like Paytm, Bhim UPI, Google Pay, PhonePe, and MobiKwik receive comprehensive support services.

3. Symbiotic Recognition of Transaction Platforms

Transaction platforms, often the unsung heroes of the BFSI ecosystem, play a pivotal role in providing holistic support services. Recognizing the symbiotic relationship between these platforms and customer satisfaction, institutions have collaborated to offer end-to-end solutions. A survey conducted by J.D. Power revealed that customers who receive comprehensive support services from transaction platforms are 30% more likely to recommend the platform to others.

Platforms like Paytm, with their user-friendly interfaces, have become synonymous with convenient transactions. However, their fame is not solely attributed to transactional ease but also to the robust support services they provide. Whether a customer encounters an issue with a payment or needs assistance navigating the application, these platforms ensure that comprehensive support is just a click away.

Elevate your BFSI customer support to unmatched levels of efficiency and satisfaction. Know how to choose the right partner for your business with insights from our blog.

Technological Challenges in BFSI

1. Rapid Technological Advancements: A Double-Edged Sword

The BFSI sector, in its pursuit of digital transformation, faces a myriad of challenges stemming from the rapid evolution of technology. According to a survey by Deloitte, 67% of financial service executives acknowledge that keeping up with technological advancements is a significant hurdle.

As digital channels become more integral to financial transactions, the industry grapples with the surge in click fraud and cybersecurity threats. Data from the Federal Trade Commission (FTC) reports a 20% increase in reported fraud cases in the financial sector over the past year.

2. Innovations to Address Challenges

Artificial Intelligence (AI): A game-changer in fraud detection, AI algorithms analyze patterns in real-time, identifying anomalies and potential threats. According to a report by McKinsey, AI adoption in the banking sector has the potential to reduce fraud-related costs by 25%.

Robotic Process Automation (RPA): RPA is streamlining routine tasks, minimizing errors, and enhancing operational efficiency. Infosys reports a 40% reduction in processing time and a 50% decrease in errors for BFSI companies employing RPA.

Internet of Things (IoT): IoT devices offer real-time monitoring of transactions and financial activities. The implementation of IoT in ATMs has resulted in a 15% decrease in downtime and a 20% increase in transaction speed, as per a study by Gartner.

Cyber Security Measures: With an annual growth rate of 10.9%, the global cybersecurity market is witnessing increased investment from BFSI players. Multi-factor authentication, encryption, and regular security audits are becoming standard practices to fortify digital ecosystems.

3. The Imperative of Robust Customer Service Solutions

In this technological battleground, the need for robust customer service solutions becomes paramount. A comprehensive customer support system acts as the first line of defense against technological threats, providing users with assistance in navigating the complexities of digital transactions securely.

As BFSI organizations integrate innovative technologies to safeguard their operations, customer service emerges as the human-centric counterpart, ensuring that clients are not only protected from potential risks but also guided seamlessly through the ever-evolving digital landscape.

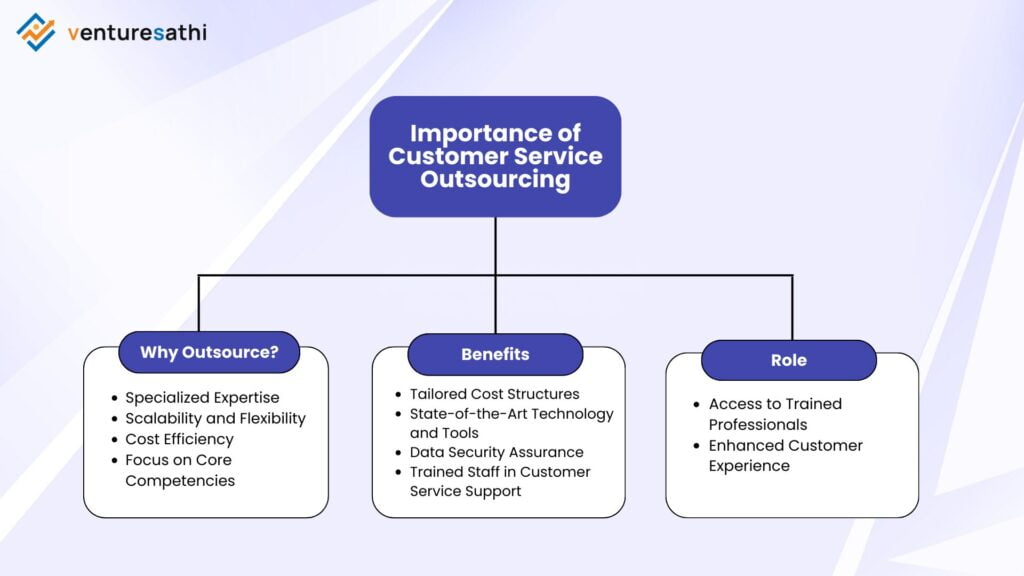

The Growing Importance of Customer Service Outsourcing

1. Why Outsourcing Has Become Crucial for BFSI

The BFSI sector, amidst its technological evolution and heightened security concerns, is increasingly turning to customer service outsourcing as a strategic imperative. This paradigm shift can be attributed to several compelling factors.

Specialized Expertise: Handling the intricate demands of customer service in BFSI requires specialized knowledge. Outsourcing firms, often experts in the field, bring a wealth of experience and a deep understanding of the industry’s nuances.

Scalability and Flexibility: The volume of customer queries in BFSI can fluctuate dramatically. Outsourcing provides the flexibility to scale operations up or down based on demand, ensuring optimal resource utilization.

Cost Efficiency: Managing an in-house customer service team involves significant overhead costs. Outsourcing allows BFSI companies to access skilled personnel at a fraction of the cost, leading to substantial savings.

Focus on Core Competencies: By entrusting customer service to external partners, BFSI organizations can redirect their internal resources toward core competencies such as innovation, product development, and risk management.

2. Benefits of Outsourcing Customer Service in BFSI

24/7 Support: The BFSI sector operates in a global environment with customers spanning different time zones. Outsourcing facilitates round-the-clock customer support, ensuring assistance is available whenever and wherever it’s needed.

Tailored Cost Structures: Outsourcing providers offer flexible pricing models, allowing BFSI companies to tailor their customer service plans according to specific needs and budgets. This agility in cost structures enhances financial planning and control.

State-of-the-Art Technology and Tools: Established outsourcing firms invest heavily in advanced technologies. BFSI outsourcing services leverage state-of-the-art tools, including predictive diallers, interactive voice response (IVR) systems, and customer relationship management (CRM) software for seamless operations.

Data Security Assurance: In an era of rising cybersecurity threats, outsourcing partners prioritize data security. Rigorous measures, including encryption, secure networks, and compliance with industry regulations, ensure the confidentiality and integrity of sensitive BFSI data.

Trained Staff in Customer Service Support: Outsourcing firms specialize in recruiting, training, and retaining skilled professionals. BFSI outsourcing services ensure that customer service representatives possess the requisite knowledge to navigate complex financial scenarios and address customer concerns effectively.

3. Role of Outsourcing in Data Security and Providing Trained Staff

Data Security Protocols: Outsourcing partners implement robust data security protocols, aligning with industry standards and compliance requirements. Regular audits and assessments are conducted to identify and mitigate potential vulnerabilities.

Access to Trained Professionals: BFSI outsourcing services focus on cultivating a talent pool equipped with financial acumen and customer service skills. Continuous training programs ensure that staff stays abreast of industry updates, regulations, and evolving customer expectations.

Enhanced Customer Experience: Trained professionals contribute to an elevated customer experience by providing accurate and insightful information. Outsourcing firms emphasize the importance of soft skills, ensuring that representatives communicate with empathy and professionalism.

Explore the benefits of contact center outsourcing for your BFSI institution with insights from our blog. Dive into expert tips and industry trends to optimize your customer service strategy.

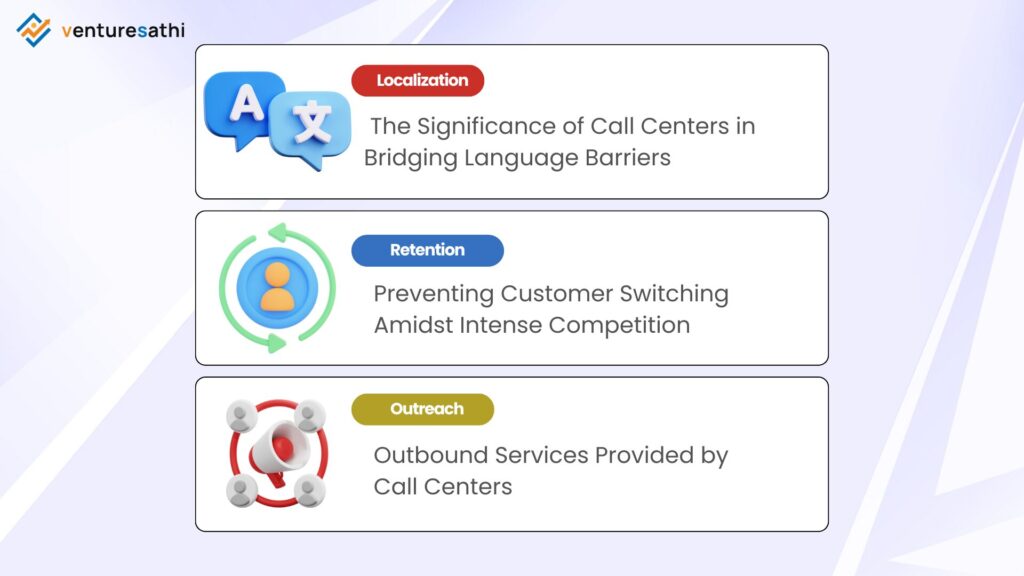

The Role of Call Centers in BFSI

1. The Significance of Call Centers in Bridging Language Barriers

Call centers play a pivotal role in the BFSI sector by acting as linguistic intermediaries, addressing the challenge of diverse global customer bases. In an environment where customers may hail from different regions with distinct languages, call centers serve as a crucial bridge, ensuring effective communication. This language inclusivity enhances customer satisfaction and fosters a sense of trust, pivotal in financial interactions.

2. Preventing Customer Switching Amidst Intense Competition

The BFSI landscape is marked by cutthroat competition, with customers having an array of options at their disposal. Call centers function as frontline defenders, employing persuasive and informative communication strategies to prevent customer attrition. Through personalized interactions, prompt issue resolution, and efficient query handling, call centers contribute significantly to customer retention, a metric of utmost importance in the competitive BFSI sector.

3. Outbound Services Provided by Call Centers

General Inquiry Calls: Inbound and outbound calls address a range of customer queries. Queries may include account information, ATM renewals, and mobile/internet banking assistance. Availability of solutions at the distance of a call ensures a seamless customer experience.

Debt Collection Calls: Outbound calls conveying consequences of non-repayment of debts. Providing customers with insights into their CIBIL scores, fostering financial transparency.

Lead Generation Calls: Outbound services aimed at generating new business opportunities. Segmentation of leads based on location, interests, and customer journey, optimizing targeting.

Loan Eligibility Checks: Inbound calls for customers checking their eligibility for bank loans. Administering questionnaires to determine eligibility criteria and guide further interactions.

Customer Survey Calls: Outbound calls conducting surveys to gauge customer satisfaction. Feedback collected aids in employee training, improving service quality, and business strategies.

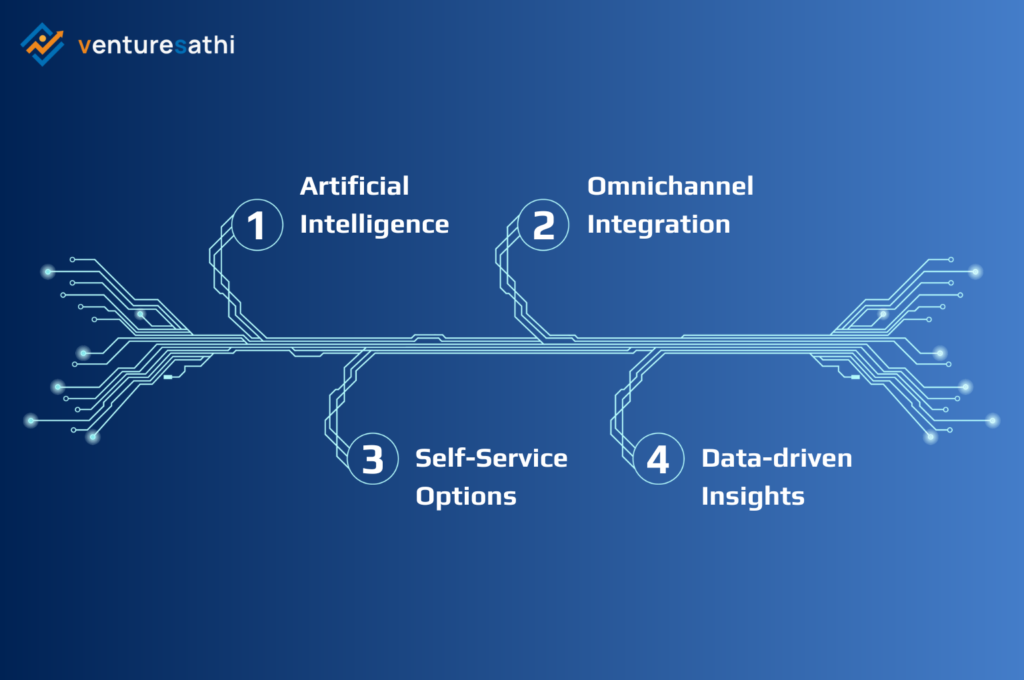

Artificial Intelligence in BFSI Customer Support

1. Global Adoption of AI Technologies in BFSI

The BFSI sector is witnessing a global surge in the adoption of Artificial Intelligence (AI) technologies. From risk management to personalized customer experiences, AI is reshaping operational landscapes. The global adoption of AI in BFSI reflects a strategic move towards leveraging data-driven insights, automation, and enhanced decision-making capabilities.

2. Growth Projections for the AI Market in the BFSI Sector

The Compound Annual Growth Rate (CAGR) for the BFSI AI market is estimated at a robust rate, underlining the sector’s enthusiasm for AI integration. The market is poised to experience exponential growth, reaching a valuation of USD 2800 million by 2024 from USD 800 million in 2019.

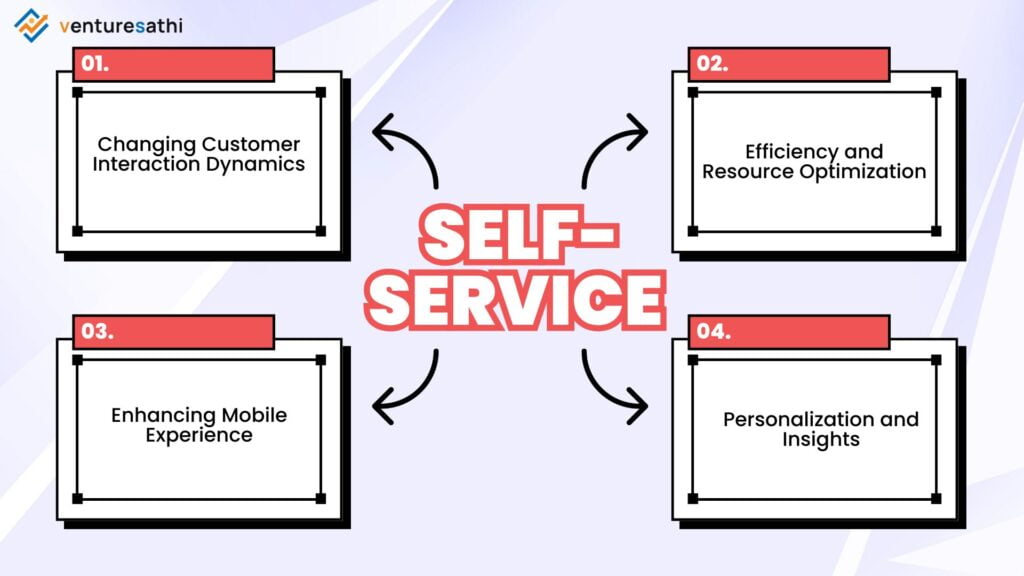

3. Role of AI-Powered Chatbots in Self-Service Customer Support

Changing Customer Interaction Dynamics: AI-powered chatbots are revolutionizing customer support dynamics, particularly in the context of mobile device usage. Customers increasingly prefer self-service options, and chatbots provide instant, round-the-clock assistance.

Enhancing Mobile Experience: Given the prevalence of mobile devices, AI-driven chatbots enhance the mobile banking experience. Real-time interactions, account inquiries, and issue resolution contribute to a seamless and user-friendly mobile interface.

Efficiency and Resource Optimization: Chatbots excel in efficiently handling routine inquiries and transactions. Resource optimization is achieved as human agents focus on complex tasks, elevating overall operational efficiency.

Personalization and Insights: AI algorithms enable chatbots to provide personalized recommendations based on customer behavior. Data-driven insights derived from chatbot interactions contribute to informed decision-making by BFSI entities.

Join us on the journey from concept to code and bring your vision to life. Take the first step in developing a successful SaaS product with our expert guidance. Read the blog to know in detail.

Conclusion

In navigating the dynamic landscape of the BFSI sector, the article has delved into several crucial facets of customer service and support. The evolving dynamics, changing paradigms in customer support, and the integration of cutting-edge technologies like AI have been explored. The challenges posed by fraud, the role of major institutions and transaction platforms, and the growing significance of customer service outsourcing have been highlighted.

Contact centers in the BFSI sector have been underscored. From bridging language barriers and preventing customers from switching to providing outbound services and adopting AI-driven solutions. The infusion of AI, particularly in the form of chatbots, is set to redefine self-service experiences, offering personalized solutions, and enhancing overall efficiency.

As we navigate the future of BFSI customer service, embracing innovation and customer-centric strategies is paramount. Explore how our tailored contact center solutions can elevate your customer support and drive excellence in the BFSI domain.

Connect with our team today to embark on a journey of transformative customer service in the BFSI sector. Your success in navigating the evolving landscape of customer support is our commitment.

Discover the true potential of your BFSI customer service. With Venturesathi’s expertise and innovative solutions, you’ll not only meet but exceed customer expectations. Take the first step towards excellence and contact us now!