Introduction

The banking and finance sector is experiencing a rapid transformation in the digital landscape. As technology advances, consumers’ expectations also evolve. Today, banking institutions face the challenge of meeting these evolving demands while ensuring efficiency, security, and compliance.

Custom software development has emerged as a critical solution for banking institutions to address these challenges effectively. Tailored software solutions enable banks to streamline operations, enhance customer experiences, and stay competitive in the digital era.

According to a report by MarketsandMarkets, the global digital banking platform market is poised for remarkable growth, projected to surge from USD 8.2 billion in 2021 to USD 13.9 billion by 2026, with a Compound Annual Growth Rate (CAGR) of 11.3%.

At Venturesathi, we specialize in providing comprehensive banking software development services to meet the unique needs of our clients. Let’s explore the various services we offer in detail.

Our banking software development services encompass a wide range of solutions tailored to the unique needs of financial institutions. From integrating core banking systems to developing mobile banking applications and secure payment processing platforms, we empower banks to streamline operations, enhance customer experiences, ensure compliance with regulatory requirements, and seamlessly integrate ERP systems for holistic management.

1. Insurance Software Development

Our insurance software development services focus on delivering:

- Efficient policy management tools

- Streamlined claims processing systems

- Enhanced underwriting and customer engagement platforms

By automating administrative processes and leveraging data analytics, we enable insurance companies to improve operational efficiency, reduce costs, and deliver superior customer service.

Ready to enhance your insurance operations? Reach out to us to discuss your software development needs.

2. Lending System Development

Our lending system development solutions are designed to:

- Expedite the loan approval process

- Simplify online loan applications

- Enhance borrower convenience and experience

- Seamlessly integrate ERP systems for comprehensive financial management

With rapid loan approval systems, seamless application processes, and personalized borrower interactions, we help banks streamline lending operations and drive customer satisfaction.

3. Financial Data Analytics Services

Our financial data analytics services provide banks and financial institutions with:

- Tools and insights needed to make informed decisions

- Optimize investments

- Navigate complex financial markets

- Integrate ERP systems for centralized data management

Leveraging advanced analytics techniques and predictive modeling, we empower our clients to gain actionable insights, mitigate risks, and capitalize on opportunities in the ever-changing financial landscape.

4. API Development

Connecting with partners to create a complex digital infrastructure is essential for fintech enterprises. Our API development services guarantee seamless integration across the entire environment, allowing businesses to implement other apps designed for monitoring, reporting, and fraud detection. This ensures improved experiences and more efficient processes, driving overall value for our clients.

5. CRM Solutions

Fintech brands require marketing technologies to grow their customer base, and our teams with marketing expertise are equipped to deliver. We develop CRMs and BPMs that optimize core marketing activities, including customer segmentation, automated communication, and client acquisition, all within a single application. With advanced automation features, our marketing tools streamline processes and drive marketing effectiveness for our clients.

Apart from the above-mentioned services we also provide payment services, trading systems, and other services.

What Sets Us Apart

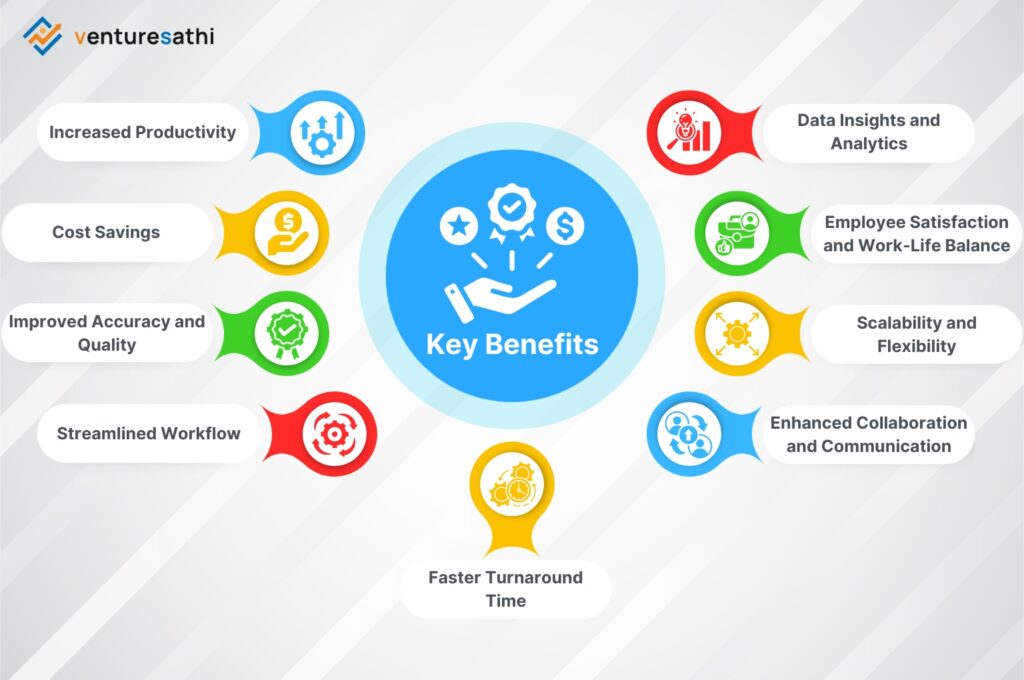

At Venturesathi, our commitment to delivering cutting-edge fintech solutions tailored to your business needs sets us apart. Leveraging the latest technologies, we ensure that our solutions remain at the forefront of innovation. Our mobile-responsive custom apps empower your customers with seamless access to your services. With our custom solutions, you retain full ownership of your software, eliminating costly licensing fees and subscriptions. We prioritize seamless integration with your existing platforms and secure data transfer through APIs, guaranteeing minimal disruption and maximum efficiency.

Additionally, our dedication to optimizing team productivity ensures a smooth transition to your new software, while our adaptability ensures that your solutions remain relevant with future advancements. Our end-to-end services, global presence, stringent data security protocols, and commitment to on-time delivery underscore our reputation for excellence, distinguishing us as the premier choice for your fintech needs.

Tech Stack We Use for Banking Software Development

1. Frontend

Our front-end development utilizes modern technologies such as HTML5, CSS3, and JavaScript frameworks like React and Bootstrap to create responsive and interactive user interfaces.

2. Backend

For backend development, we leverage robust programming languages like Express.js, Python, and Node.js, along with frameworks such as Spring Boot and Django, to build scalable and secure server-side applications.

3. Database

We work with reliable database management systems like MySQL, PostgreSQL, and MongoDB to store and manage data efficiently, ensuring reliability, performance, and data integrity.

4. Continuous Integration and Continuous Deployment

To streamline development, testing, and deployment processes, we implement Continuous Integration and Continuous Deployment (CI/CD) pipelines. we ensure seamless integration of code changes, automated testing, and rapid deployment, enabling faster time-to-market and enhanced software quality.

Ready to transform your banking operations? Partner with Venturesathi for innovative custom software solutions.

Security Measures in Banking Software Development

Security is paramount in banking software development. We prioritize essential security measures such as authentication, encryption, and access control to protect sensitive financial data and ensure the integrity of banking systems. We implement robust authentication mechanisms, including multi-factor authentication and biometric authentication, to verify the identity of users and prevent unauthorized access.

Encryption techniques such as SSL (Secure Sockets Layer)/ TLS (Transport Layer Security) are used to secure data in transit and at rest, ensuring confidentiality and integrity. Access control mechanisms are employed to restrict user access based on roles and permissions, minimizing the risk of unauthorized actions.

We conduct regular security assessments, including penetration testing and code reviews, to identify and mitigate vulnerabilities in banking systems. Compliance with industry regulations such as PCI DSS (Payment Card Industry Data Security Standard) and GDPR (General Data Protection Regulation) is ensured to maintain data security and privacy standards, avoiding legal and financial repercussions.

Ensure the security of your banking systems with our robust solutions. Contact us to fortify your digital infrastructure.

Takeaway

Custom software applications are empowering banking institutions to meet the evolving needs of customers, enhance operational efficiency, and stay ahead in the competitive market. At Venturesathi, we are committed to delivering innovative and tailored solutions that enable our clients to achieve their business objectives and drive success in the digital era. Contact us today to learn more about how we can help you transform your banking operations and stay ahead of the curve.

Transform your banking operations with our custom software solutions. Contact Venturesathi today.

Keep up the great work! Thank you so much for sharing a great posts.