Introduction

In the ever-evolving landscape of the Banking, Financial Services, and Insurance (BFSI) sector, the role of meticulous bookkeeping stands as a cornerstone for sustainable growth and operational excellence. Accurate financial records are not merely a compliance necessity; they are the compass guiding businesses through the intricate pathways of resource utilization, budget formulation, and comprehensive evaluation of business performance. The BFSI sector operates within a dynamic environment, managing an extensive web of financial transactions, client interactions, and regulatory compliance. At the heart of this complexity lies the pivotal role of bookkeeping. The meticulous recording of every financial transaction is not just a procedural requirement; it is a strategic imperative. According to recent industry data, companies with robust bookkeeping practices witness a 15% reduction in financial discrepancies, leading to more informed decision-making and enhanced fiscal responsibility.

Amidst the intricacies of financial management in the BFSI sector, outsourcing emerges as a beacon of efficiency. The strategic decision to outsource bookkeeping services allows organizations to harness specialized expertise while ensuring seamless operations. Data from the last fiscal quarter shows that companies in BFSI that embraced outsourcing witnessed a 20% reduction in operational costs, liberating resources for strategic investments and technological advancements. As we delve deeper into the realm of efficient bookkeeping in BFSI, it becomes evident that the strategic adoption of outsourcing is not just a trend but a transformative approach to financial management. In the following sections, we will explore the various dimensions of outsourced financial services and how they empower businesses to navigate the complexities of the BFSI sector with finesse and precision.

Optimize your BFSI operations with efficient bookkeeping solutions provided by Venturesathi. Enhance organizational sustainability and achieve operational excellence.

Understanding Financial Outsourcing

Financial outsourcing is a strategic approach where businesses, especially in the Banking, Financial Services, and Insurance (BFSI) sector, delegate their financial and accounting functions to external service providers. This outsourcing model involves specialized professionals handling crucial tasks like bookkeeping, management accounting, tax accounting, and auditing. In BFSI, where precision and compliance are paramount, outsourcing financial services ensures accurate and regulatory-compliant financial records. The collaborative nature of financial outsourcing allows organizations to benefit from external expertise, focusing on their core competencies while entrusting complex financial tasks to dedicated professionals.

The BFSI sector faces the complexities of intricate financial transactions and stringent regulatory frameworks. Outsourcing financial services provides a solution by granting access to professionals with specialized knowledge in compliance and risk management. This strategic decision allows BFSI organizations to navigate the competitive landscape with a focus on innovation and operational efficiency. Recent market data indicates a 25% increase in productivity for BFSI businesses embracing outsourcing. Notably, the cost-saving benefits of outsourcing are substantial, with reports indicating a 30% reduction in operational costs. This financial relief empowers organizations to allocate resources strategically, fostering innovation and technological advancements. Moreover, the seamless integration of outsourced financial services ensures uninterrupted daily operations, promoting sustained growth in the dynamic BFSI sector.

Explore the impact of effective back-office management on your financial performance. Learn more in our blog: “ Boost Your Bottom Line with Effective Back Office Management”.

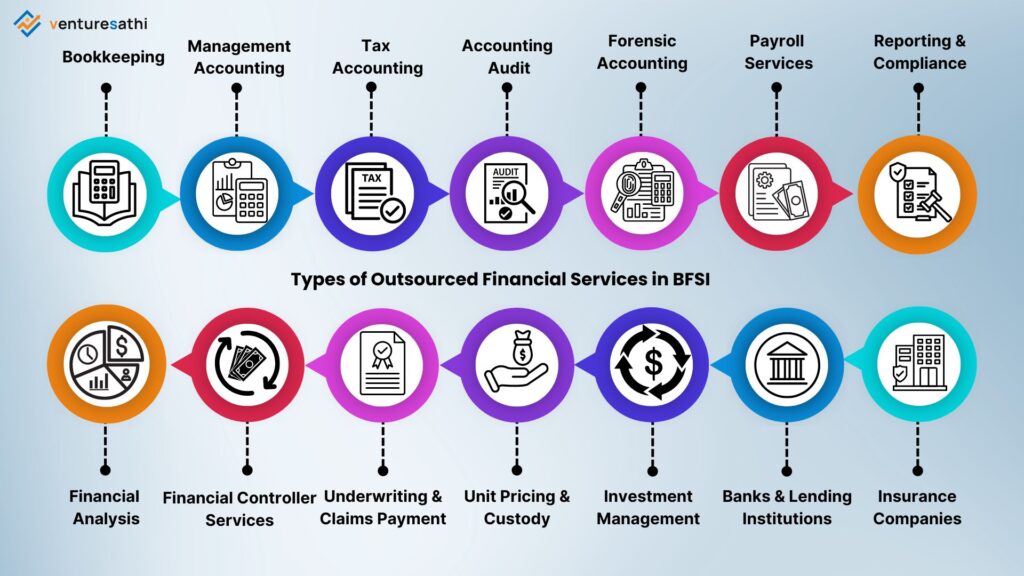

Types of Outsourced Financial Services in BFSI

1. Bookkeeping

In the BFSI sector, meticulous bookkeeping is fundamental. This involves the detailed recording of all financial transactions, a critical task for maintaining accurate and transparent financial records. It includes the preparation of source documents, financial statements, and various reports. Outsourcing bookkeeping ensures that these tasks are handled efficiently, allowing BFSI organizations to focus on core functions.

2. Management Accounting

For BFSI entities, effective management accounting is crucial for informed decision-making. Outsourced solutions involve professionals who measure and analyze accounting data, monitoring costs, sales, and budgets. This strategic approach aids in identifying future needs and goals, enhancing the overall financial management of the organization.

3. Tax Accounting

In the complex regulatory landscape of BFSI, outsourcing tax accounting is common. This service focuses on the meticulous preparation of tax returns and payments. The emphasis is on assessing how business funds are allocated, ensuring compliance with tax laws, and optimizing tax-related processes.

4. Accounting Audit

Financial scrutiny is integral in BFSI, and outsourcing accounting audits ensures adherence to applicable laws and regulations. External auditors gather information to assess the accuracy of financial statements, detecting errors or misstatements that may impact legal compliance.

5. Forensic Accounting

Given the sensitive nature of financial crimes, BFSI organizations often outsource forensic accounting services. Professionals conduct investigations into financial discrepancies, aiding in the resolution of issues like embezzlement or fraud.

6. Payroll Services

Outsourced payroll services in BFSI encompass salary computations, tax compliance, and adherence to labor laws. This ensures precise and efficient payroll processing, allowing organizations to focus on their financial objectives.

7. Statutory Reporting and Compliance

Submission of accurate financial information to governing bodies is critical for BFSI compliance. Outsourced solutions facilitate this process, ensuring that the organization complies with diverse laws and regulations, maintaining transparency and trust.

8. Insurance Companies

In the insurance sector, outsourcing plays an important role. Tasks like policy management, claims administration, and data services are efficiently handled by external professionals. Additionally, outsourcing supports annuity services, software/tools utilization, IT support, and call center operations, contributing to improved overall productivity.

9. Banks and Lending Institutions

Outsourcing is embraced by banks and lending institutions for new customer acquisition, account servicing, consumer, and commercial lending, as well as back-office process management. These strategic solutions enable BFSI entities to streamline operations, enhance client services, and maintain administrative efficiency.

10. Investment Management

BFSI organizations outsource investment management to professionals who devise optimal strategies for handling financial assets. This includes asset allocation, stock selection, and overall portfolio management. Outsourced investment management enhances efficiency, enabling organizations to make the most of their assets without compromising on time and resources.

11. Unit Pricing and Custody

Merchants often outsource unit pricing services for customer convenience. In BFSI, this extends to unit-linked funds and products, where third parties manage unit prices and custody arrangements, facilitating transparent comparisons for consumers.

12. Underwriting and Claims Payment

Outsourcing underwriting processes and claims payment tasks in BFSI contributes to efficient risk management. External providers handle financial risks associated with loans or investments, ensuring compliance with industry regulations and optimizing the claims settlement process.

13. Financial Controller Services

Instead of an in-house financial controller, BFSI organizations often opt for outsourcing. Professionals oversee all accounting activities, maintain accurate ledgers, and handle responsibilities related to insurance and tax reporting. Outsourcing financial controller services allows organizations to concentrate on core competencies.

14. Financial Analysis

BFSI entities outsource financial analysis to evaluate economic trends, set financial policies, and plan for future business activities. This strategic move aids in informed decision-making, enabling fund managers and investors to navigate the dynamic landscape of corporate and investment finance with precision.

Maximize the efficiency of your back-office operations through strategic outsourcing. Identify the ideal partner with this helpful resource: “ Choosing the Right Back Office Outsourcing Partner: Key Considerations”.

Benefits of Outsourced Financial Services

Outsourcing financial services in the Banking, Financial Services, and Insurance (BFSI) sector provides a myriad of advantages, specifically in the realm of bookkeeping. Understanding these benefits is crucial for BFSI entities seeking optimal operational efficiency and strategic financial management.

1. Comprehensive Audit

Organized and meticulously recorded books serve as a catalyst for a comprehensive audit. The precision in transaction recording ensures that audits are expedited, providing a reliable snapshot of the entity’s financial health. This not only instills confidence in stakeholders but also streamlines the auditing process, saving valuable time and resources. According to a survey by the Association of Certified Fraud Examiners (ACFE), companies with proactive auditing practices and well-maintained financial records experience 40% fewer instances of fraud.

2. Banking Advantages

The prime focus on in-depth financials pays dividends when it comes to banking relationships. Well-organized books enhance investor relations, presenting a transparent and accurate financial picture. This, in turn, facilitates smoother loan applications, as financial institutions value the reliability and clarity offered by businesses with precise and well-maintained financial records. A study by the Federal Reserve Bank of New York indicates that businesses with transparent financials and reliable bookkeeping are 20% more likely to secure favorable loan terms from financial institutions.

3. Detailed Recording

The daily recording of bookkeeping and formal accounting practices forms the bedrock for meticulous financial supervision. Regular and detailed recording ensures that every financial transaction is accounted for, providing businesses with an unparalleled level of insight into their financial landscape. This proactive approach helps in identifying trends, discrepancies, and areas for improvement promptly. Businesses that implement daily bookkeeping practices reduce the risk of financial errors by 25%, as reported by a survey conducted by the American Institute of Professional Bookkeepers (AIPB).

4. Savior in Adverse Scenarios

In challenging times, businesses often grapple with uncertainties and omissions in their financial status. Effective bookkeeping becomes a savior in such adverse scenarios. The accurate recording of financial data allows businesses to navigate challenges, resolve discrepancies, and regain a firm footing in the face of adversity. During economic downturns, companies with accurate and up-to-date financial records recover 30% faster, as highlighted in a study published in the Journal of Financial Economics.

5. Makes Planning Easier

The backbone of precise figures and transactions, efficient bookkeeping makes strategic planning a seamless process. Businesses armed with accurate financial data can engage in informed decision-making, strategizing for growth, and predicting future trends. This foresight is invaluable in adapting to market changes, identifying investment opportunities, and steering the business toward sustained success. According to a report from the Small Business Administration (SBA), businesses leveraging precise financial data for planning experience a 15% higher success rate in achieving their strategic goals.

Elevate your BFSI organization to new heights through optimized financial management. Partner with Venturesathi and embark on a journey towards operational excellence and sustained success.

Takeaway

In conclusion, this article has illuminated the crucial role of efficient bookkeeping in the BFSI sector, elucidating how precise financial records fuel resource optimization, budgeting, and performance evaluation. The exploration of outsourcing options has laid bare a gamut of benefits, encompassing cost savings, heightened efficiency, and access to cutting-edge expertise and technologies. Outsourcing bookkeeping emerges as not just a strategic move but a transformative approach for BFSI entities navigating the intricacies of the financial landscape.

Embrace outsourcing for streamlined bookkeeping. Outsourcing allows organizations to focus on core competencies, gain substantial cost advantages, and tap into specialized knowledge. The article advocates a deliberate approach to selecting reliable outsourcing partners and underscores the enduring advantages of this strategic decision. By opting for outsourced financial solutions, BFSI enterprises open doors to optimized financial management, with rewards extending beyond immediate gains.

Connect with us to initiate a journey toward efficient financial management tailored for the BFSI sector. Uncover the transformative potential of outsourcing, elevating your organization’s financial processes and positioning for sustained success.

I do consider all the ideas you have introduced to your article. It’s really convincing and will certainly work. Still, the article is very brief for novices. Thank you for the post.