Introduction

In the fast-changing world of finance, non-banking financial companies (NBFCs) are becoming more important for India’s economy. A recent report shows that NBFCs are expected to grow by 11-12% to Rs 13 lakh crore by the end of FY 2023. This growth highlights the need for NBFCs to have the right technology and infrastructure to grow and keep running smoothly.

One key part of this technology is NBFC software. It helps NBFCs with their everyday tasks and helps them grow. NBFC software is more than just a tool, it helps NBFCs manage their work well, give great customer service, and deal with the complexities of finance. With good NBFC software, companies can do their work better, make better decisions, and stay ahead of others.

In this blog, we will delve into the top features that every NBFC software solution should have in 2024. These features enhance customer satisfaction, improve operational efficiency, and drive growth for NBFCs. Let’s explore how NBFC software can empower your organization to thrive in today’s dynamic financial environment.

Tailor your software to suit your specific needs with Venturesathi’s customizable solutions. Explore our range of services for seamless integration into your business processes.

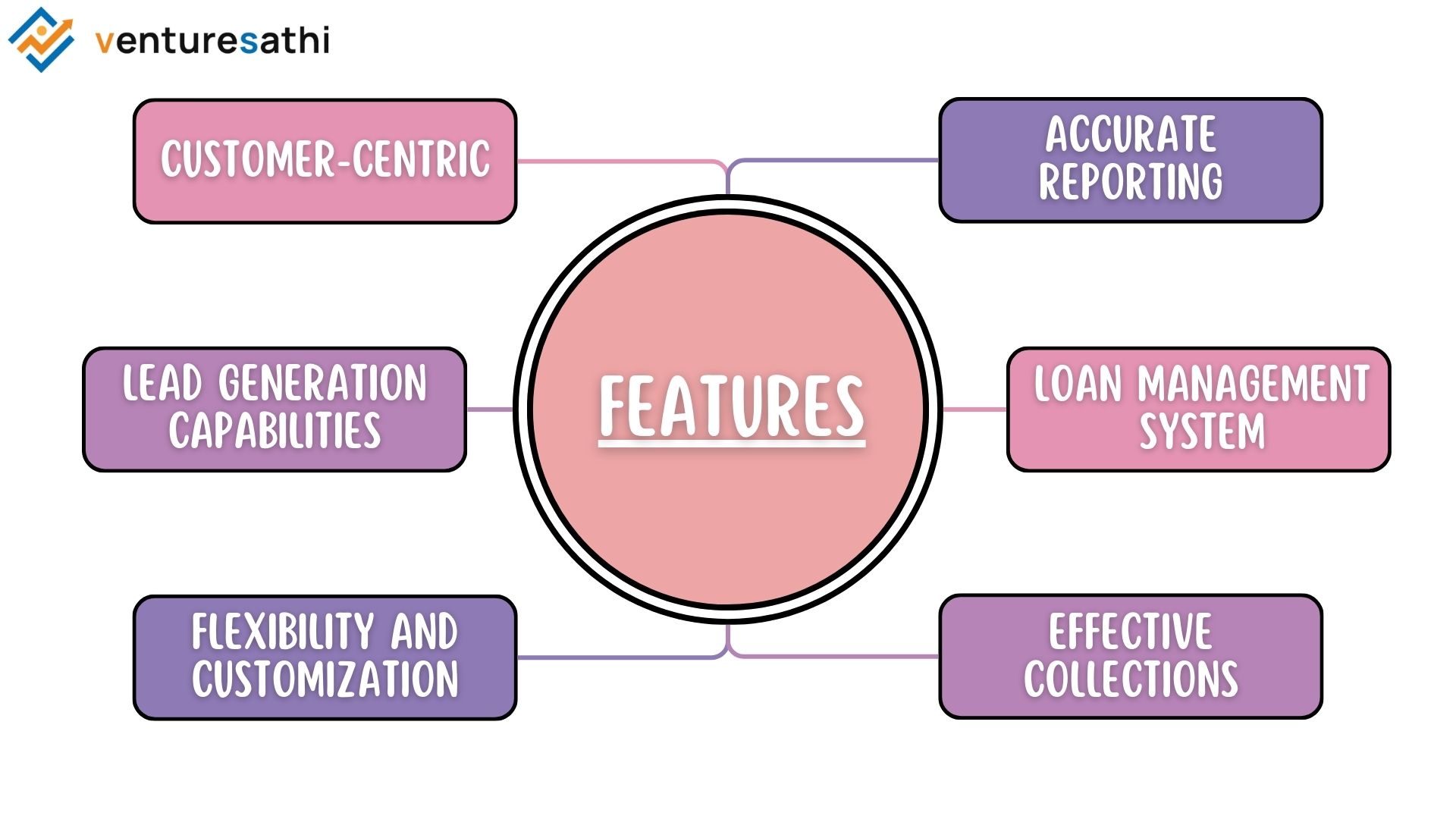

Customer-Centric Features

One of the primary goals of any NBFC should be to enhance the customer experience. Customer-centric features in software play a crucial role in achieving this goal. These features should include easy access to customer details, comprehensive product information, and a user-friendly interface.

By prioritizing customer-centricity, NBFCs can significantly enhance customer satisfaction and streamline their business processes. A well-designed software solution should make it easy for customers to apply for small loans, explore different loan types, and manage their credit through a convenient loan app.

Explore how our custom software applications can revolutionize your banking operations. Learn more about our tailored solutions for enhanced efficiency and customer satisfaction.

Lead Generation Capabilities

Lead generation is essential for the growth of NBFCs. A robust software solution should include features that support lead-generation campaigns. These features may include tools for targeted campaigns, lead management, and analytics to track the effectiveness of these campaigns.

By investing in lead generation capabilities, NBFCs can expand their customer base and increase their loan portfolio. This, in turn, can contribute to the overall growth and profitability of the organization.

Flexibility and Customization

Flexibility and customization are key requirements for NBFC software solutions. Every NBFC has unique requirements based on its business model and target market. A good software solution should offer flexibility to adapt to these requirements and provide customization options for adding new products or changing existing ones.

By offering flexibility and customization, NBFC software can improve operational efficiency and enable organizations to stay competitive in a rapidly changing market.

Unlock the potential of automation in BFSI processes with Google Workspace. Explore our insights on streamlining operations and maximizing productivity through seamless integration with Google’s powerful tools.

Loan Management System (LMS)

An efficient Loan Management System (LMS) is crucial for the smooth functioning of NBFCs. The LMS should facilitate fast and accurate processing of loans, from onboarding customers to disbursing funds. Key features of a good LMS include KYC verification, loan processing, and disbursement.

A robust LMS can reduce manual processing, minimize errors, and ensure accurate reporting. This, in turn, can improve the overall efficiency of NBFC operations.

Accurate reporting

Accurate reporting is crucial for NBFCs to comply with regulatory requirements and monitor their performance. NBFC software provides features for generating reports in the required formats and on time. This includes automated reporting tools that streamline the reporting process and ensure accuracy. Prioritizing reporting and compliance features, helps NBFCs meet regulatory requirements and make informed business decisions.

Effective collections

Collections are a critical aspect of NBFC operations, and an effective collections management system is essential for ensuring timely payments. NBFC software should include features for real-time monitoring of collections and timely reminders for unpaid dues. Additionally, it should provide tools for managing collections agents and tracking collection activities. By implementing an efficient collections management system, NBFCs can improve their profitability and reduce the risk of defaults.

Benefits of NBFC Software

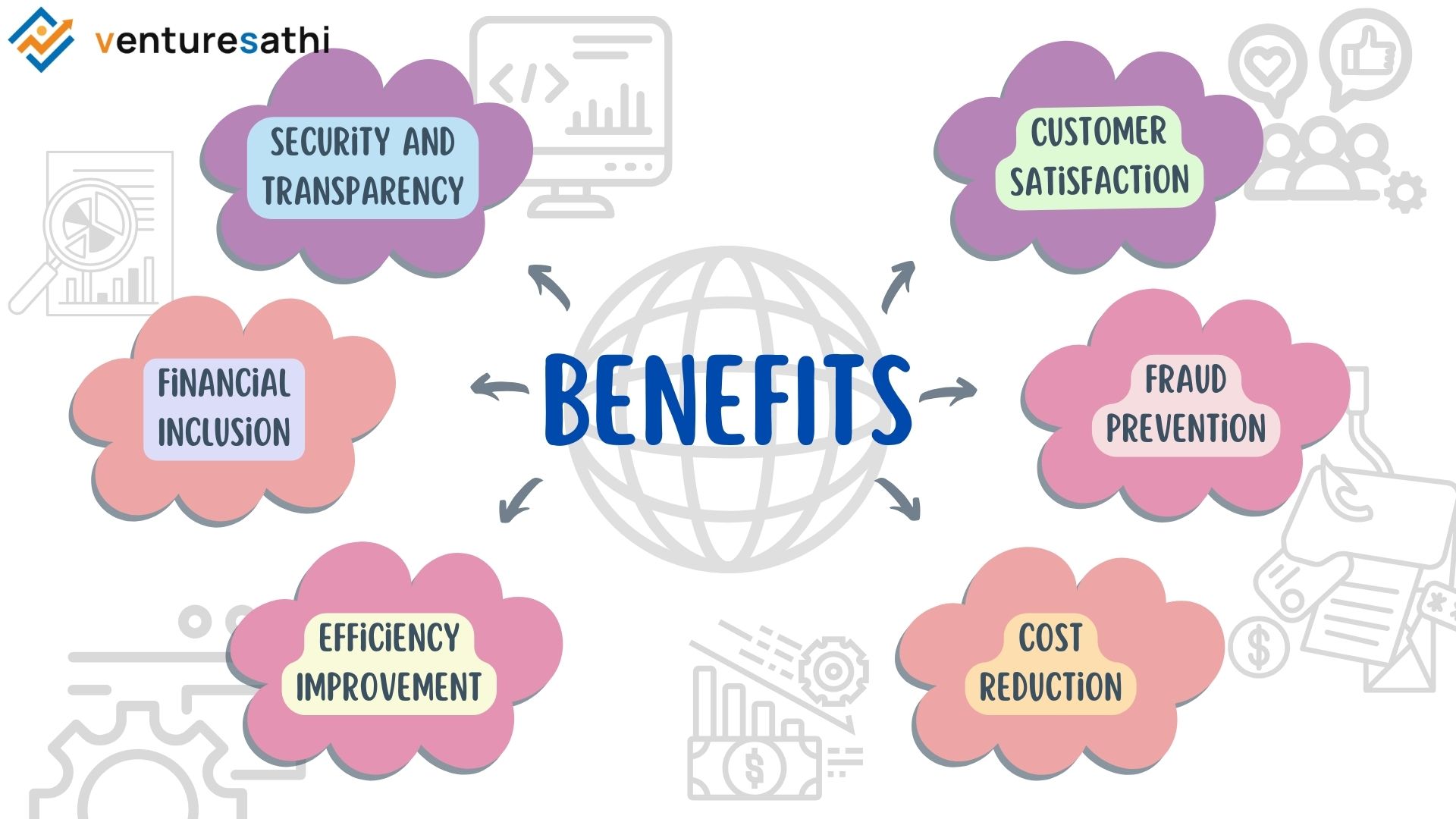

By choosing our NBFC software, NBFCs can unlock a host of benefits that can significantly enhance their operations and customer service:

Security and Transparency: Our software ensures data safety through encryption and promotes operational transparency.

Customer Satisfaction: With user-friendly interfaces and timely information, our software enhances the customer experience.

Financial Inclusion: Leveraging alternative indicators for credit assessment, our software helps include more people in the financial system.

Efficiency Improvement: Our software reduces errors and delivery times by automating processes, such as customer onboarding and loan processing.

Cost Reduction: Implementing e-KYC, paperless documentation, and reducing manual hours, our software helps NBFCs save on operational costs.

Fraud Prevention and Detection: Through end-to-end solutions and additional security layers like OTP and biometrics, our software helps prevent and detect fraud.

Discover how our software development services can propel your fintech startup or financial service provider to new heights. Explore our expertise in building innovative solutions tailored to your unique requirements.

Takeaway

The right software solution is critical for the growth and sustainability of NBFCs. By prioritizing customer-centric features, lead generation capabilities, flexibility, and customization, NBFCs can enhance their operational efficiency and customer satisfaction. Additionally, investing in robust LMS, reporting, and collections management features can further improve the overall performance of NBFCs. It’s essential for NBFCs to carefully evaluate their software options and choose a solution that meets their specific requirements and future growth plans.

If you’re an NBFC looking to upgrade your software solution to meet the evolving needs of your business, explore our range of NBFC software solutions. Contact us today to learn more about how our software can help you achieve your business goals.

Experience seamless customer interaction and enhance satisfaction with Venturesathi’s tailored software solutions. Explore our services to elevate your customer experience. Contact us today!