Introduction

Compliance with regulatory standards is crucial in the banking sector, as it ensures stability, security, and transparency of financial transactions. Failure to comply can lead to penalties, reputation damage, and operational disruptions. Scalability is essential for sustained growth and agility in response to market changes.

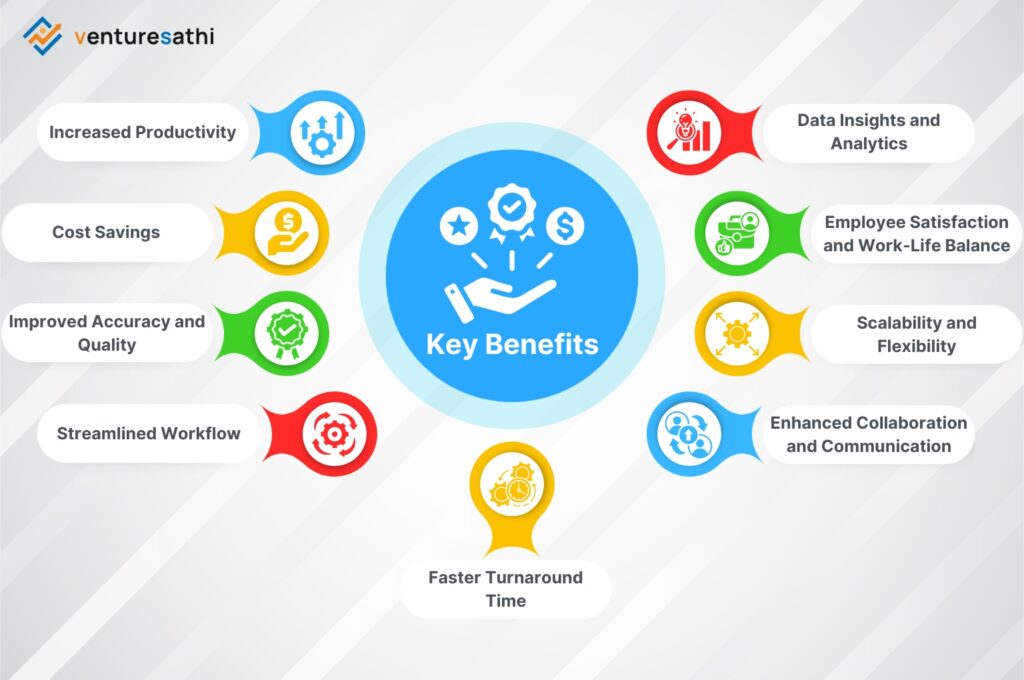

Google Workspace, a cloud-based productivity tool, offers real-time collaboration, centralized management, and robust security measures for banking professionals. It streamlines workflows, improves communication, and ensures compliance with regulatory standards, making it a valuable tool for modern businesses.

Experience seamless automation in your BFSI processes with Venturesathi’s Google Workspace services. To streamline your operations and maximize efficiency Contact us today!

Regulatory Compliance Achieved through Google Workspace Automation

Google Workspace is a powerful tool for the banking industry, offering a suite of document management, storage, and security tools. Its tools like Google Drive, Docs, Sheets, and Forms enable secure document creation, collaboration, and storage. Additionally, it can automate workflows, enhancing operational efficiency and ensuring compliance with regulatory mandates like KYC, AML, and GDPR.

Google Workspace can be used for KYC compliance, AML compliance, and GDPR compliance. It can create automated workflows for KYC verification, monitor transactions for suspicious activities, and enforce data encryption policies. It can also integrate with third-party APIs for real-time identity verification and regulatory watchlist screening. Its robust security features ensure data protection and privacy.

Revolutionize your banking operations with custom software applications. Explore our article: “Tech Solutions for Banking: Custom Software Applications.”

Scalability Enhancement with Google Workspace Automation

Banking organizations can improve their operations and scalability with the use of Google Workspace, a cloud-based solution. It takes advantage of Google Drive’s scalable storage capacity and Google Cloud Platform’s sophisticated processing capabilities to save infrastructure costs while allowing for seamless expansion.

It also includes automation tools such as Google Apps Script, which streamline repetitive operations like data entry and document generation. Furthermore, it enables seamless interaction with third-party applications and APIs, improving interoperability and allowing banks to focus on value-added activities. This improves scalability and operational flexibility.

In real-world scenarios, banking institutions leverage Workspace automation to enhance regulatory compliance and scalability significantly. By adopting tailored automation solutions, banks can streamline operations, boost efficiency, and ensure adherence to regulatory standards.

Streamline Your BFSI Workflows: Discover the Power of Google Workspace Automation. Read the insightful article: Automating BFSI Processes with Google Workspace

Real World Examples

Example 1: PayPal

PayPal efficiently utilizes Google Workspace to aggregate and analyze customer and merchant data, enabling proactive identification and prevention of fraudulent activities.

Example 2: NatWest Markets

NatWest Markets scales its predictive risk modeling and regulatory compliance seamlessly with Google Workspace, ensuring limitless scalability to meet evolving demands.

Example 3: CME Group

CME Group leverages Google Workspace for flexible and cost-effective market data access, empowering firms to mitigate risks effectively and drive revenue growth.

Example 4: Goldman Sachs

Goldman Sachs employs Google Cloud to simplify the application of consistent security policies, ensuring robust data protection measures across its operations.

Example 5: Allianz & Munich Re

Allianz and Munich Re collaborate to assist insurance customers in reducing cloud security risks and operational costs through innovative Google Workspace solutions.

Optimize Your NBFC Operations in 2024: Explore the Top 6 Essential Software Features

EndNote

Automation technology is poised to revolutionize the banking industry by addressing regulatory compliance and scalability challenges. Advancements in artificial intelligence, machine learning, and robotic process automation offer opportunities for banks to enhance compliance and scalability. AI-powered algorithms can detect fraudulent activities, while RPA solutions automate repetitive tasks.

The future of automation technology in banking could see integration with blockchain and IoT, enabling secure transaction processing and identity verification. Natural language processing and cognitive automation can automate complex regulatory reporting tasks, reducing compliance risks.

Discover the efficiency of Venturesathi‘s Google Workspace automation. Elevate your operations, enhance productivity, and streamline your business processes with our tailored solutions. Contact us today to optimize your workflow!