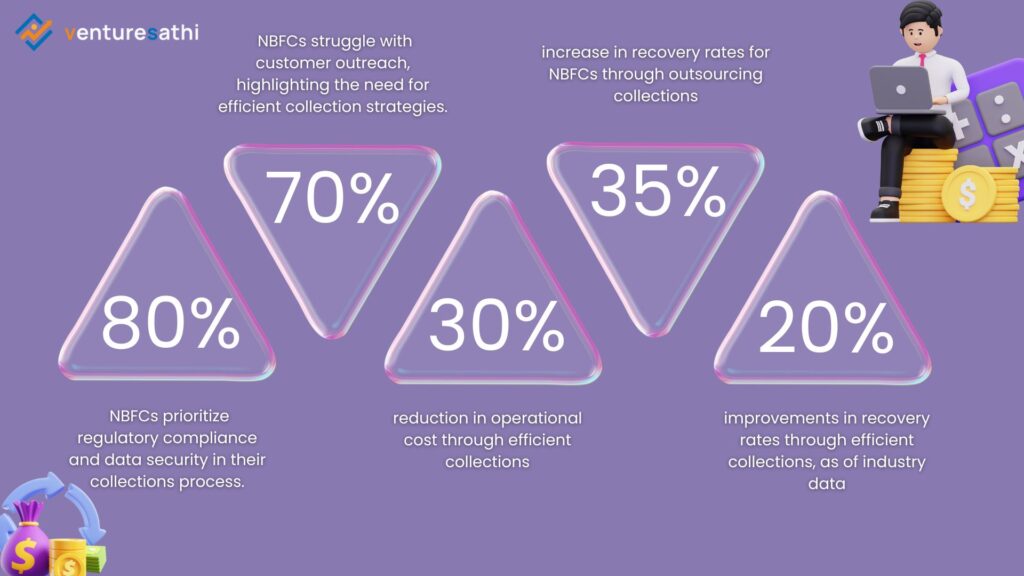

Efficient collections are imperative for sustaining growth and maintaining financial health in the NBFC sector. Collection Process Outsourcing (CPO) services play a crucial role in helping NBFCs streamline their collection process, reduce operational costs, and improve customer experience. Tailored Collection Process Outsourcing services for NBFCs, addressing unique challenges with tools and expertise for market success. According to industry data, efficient collections can improve recovery rates by up to 20% and reduce operational costs by 30%.

Don’t let back-office tasks hold you back. Leverage Venturesathi’s expertise to achieve your business goals. Connect with us today!

Importance of efficient collections for NBFCs

Efficient collections are the backbone of NBFC operations, ensuring a steady cash flow and minimizing the risk of defaults. Our Collection Process Outsourcing services are designed to optimize the collections process, improve recovery rates, and reduce operational costs. By outsourcing collections to us, NBFCs can focus on core business activities while we handle the complexities of collections management. Studies have shown that outsourcing collections can lead to a 15-20% increase in recovery rates and a 25-30% reduction in operational costs for NBFCs.

The Growth of NBFCs in India

The NBFC sector in India has witnessed significant growth in recent years, driven by factors such as increasing demand for credit, regulatory changes, and digitalization. Consequently, as NBFCs continue to expand their operations, the need for efficient collections management becomes more pronounced. According to records from the RBI, as of March 31, 2021, the NBFC sector (which includes HFCs) had belongings well worth greater than INR fifty-four trillion, equal to approximately 25% of the asset size of the banking sector.

Reduce costs, improve efficiency, and gain a competitive edge. Partner with Venturesathi for back-office success. Explore more today!

Challenges Faced by NBFCs in Collections

Despite the growth of the NBFC sector, collections remain a major challenge for many companies. Customer outreach, timely repayments, and regulatory compliance are key challenges faced by NBFCs in collections management. Our Collection Process Outsourcing services are designed to address these challenges by providing NBFCs with the expertise and support needed to optimize their collection process and improve recovery rates. According to a survey, 70% of NBFCs struggle with customer outreach, highlighting the need for efficient collection strategies.

Discover the essential features every NBFC software solution should have in 2024. Stay ahead of the curve and elevate your operations to new heights. Learn more now!

Role of Collection Process Outsourcing (CPO)

Our Collection Process Outsourcing services play a crucial role in helping NBFCs streamline their collection process and improve efficiency. By outsourcing collections to us, NBFCs can benefit from our expertise in collections management, reduce operational costs, and improve recovery rates. Our team of experts works closely with NBFCs to develop customized collection strategies that align with their business goals and regulatory requirements. Studies have shown that outsourcing collections can lead to a 20-30% reduction in operational costs and a 25-35% increase in recovery rates for NBFCs.

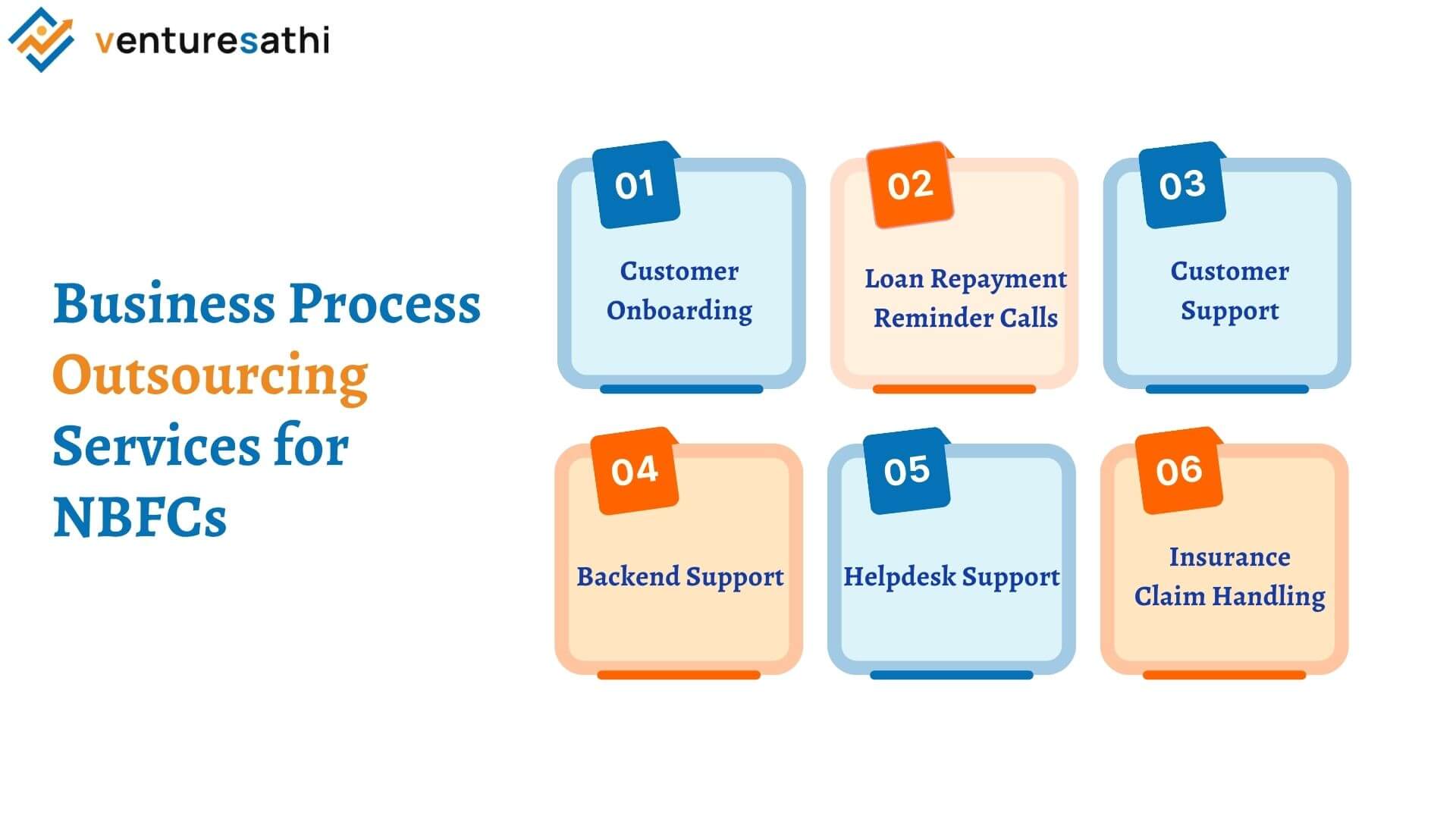

Business Process Outsourcing Services for NBFCs

We offer a comprehensive range of services to help NBFCs improve their collection process. From customer onboarding to loan repayment reminders, our services are designed to enhance the overall customer experience and improve recovery rates. Our team of experts works closely with NBFCs to develop customized collection strategies that align with their business goals and regulatory requirements. According to industry data, outsourcing collections can lead to a 15-20% increase in recovery rates and a 25-30% reduction in operational costs for NBFCs. Here are the call center services designed to address key challenges faced by NBFCs and enhance operational efficiency, ultimately improving customer satisfaction and retention:

- Customer Onboarding/Acquisition: In a competitive market, many new NBFCs struggle to attract customers to their platforms. Our call center experts assist in signing up potential customers on your website or mobile application, thereby expanding your user base and market share.

- Loan Repayment Reminder Calls: Recovering funds from defaulting customers is crucial for NBFCs. Our services ensure timely and effective reminders, reducing the risk of loss associated with unpaid loans.

Customer Support: Providing excellent customer service is essential for retaining customers and fostering repeat business. Our 24/7 support services cater to customer inquiries and complaints across multiple channels such as voice, chat, email, and social media.

- Backend Support: Processing a large volume of loan applications manually can be time-consuming and costly. Outsourcing backend services to us helps streamline the application review process, reducing manpower costs.

- Helpdesk Support: Many NBFCs use mobile applications to engage customers throughout their journey. Our helpdesk outsourcing services offer in-app chat, email, and voice support to assist customers with any technical issues related to your app.

- Insurance Claim Handling: For NBFCs offering insurance services, managing insurance claims is essential. Our inbound, outbound, and back-office services help streamline the handling of insurance claims, saving time and costs.

Optimize your back-office operations and supercharge your BFSI success. Streamline processes, improve efficiency, and drive growth. Read the full article: Supercharge Your BFSI Success with Back Office Optimization!

Regulatory Compliance and Data Security

Regulatory compliance is a key concern for NBFCs, and our Collection Process Outsourcing services are designed to ensure compliance with regulatory requirements. We take data security seriously and implement robust measures to protect sensitive customer information. With our Collection Process Outsourcing services, NBFCs can rest assured that their collections process is compliant with regulatory standards and that their customers’ data is secure. According to industry reports, 80% of NBFCs prioritize regulatory compliance and data security in their collections process.

Unlock banking compliance and scalability effortlessly with Google Workspace. Experience seamless integration and enhanced productivity. Read the article to gain more insights!

Takeaway

Collection Process Outsourcing (CPO) offers significant advantages for Non-Banking Financial Companies (NBFCs) in India. By opting for CPO, NBFCs can streamline operations, reduce costs, and enhance customer experience. Outsourcing collections enable NBFCs to leverage specialized companies’ expertise, improving recovery rates and operational efficiency. Moreover, outsourcing can help NBFCs provide a seamless and professional experience for customers, ultimately boosting customer satisfaction and loyalty. Encouraging NBFCs to consider outsourcing as a strategic option for improving collections efficiency and achieving their business objectives. Reach out to us today to explore how our CPO services can benefit your NBFC and drive better results.

We design our Collection Process Outsourcing services to help NBFCs streamline their collection process, reduce operational costs, and enhance customer experience. By outsourcing collections to us, NBFCs can focus on core business activities while we handle the complexities of collections management. Partner with us today and take your collections process to the next level.

Focus on your core business. Streamline your back office with Venturesathi’s expert outsourcing solutions. Contact us today!