Introduction

The very cornerstone of the banking industry rests on one unwavering principle: impeccable financial management. Navigating a landscape defined by stringent regulations, banks entrust themselves with safeguarding vast sums of money and orchestrating complex transactions. Here, the need for accurate financial records isn’t a luxury, it is an absolute necessity.

Think of them as the lifeblood of informed decision-making, the bedrock of regulatory compliance, and the fuel that ignites investor confidence. Just one misstep, one misplaced decimal, can trigger a domino effect: hefty penalties, eroded trust, and a tarnished reputation – consequences no bank can afford.

So, how do they achieve this financial tightrope walk? Enter the strategic partnership known as outsourced accounting services. Banks can streamline their accounting functions by joining forces with specialized firms or professionals and delegating tasks like bookkeeping and tax reporting to experts.

This shift unlocks a treasure trove of benefits. Imagine leveraging cutting-edge technology and scalable solutions, all while your team focuses on the core operations that define your unique banking magic. The outcome? Efficiency gains, enhanced accuracy, and unwavering compliance – a trifecta that strengthens your financial foundation and fuels future success.

Transform your banking operations with cutting-edge accounting solutions from Venturesathi. Achieve financial excellence and ensure regulatory compliance, while empowering your institution for success.

Understanding Outsourced Accounting Services for Banks

Definition and scope of outsourced accounting services

Outsourced accounting services for banks involve delegating various accounting functions to external firms or professionals. This strategic partnership enables banks to access specialized expertise, advanced technology, and scalable solutions for their accounting needs. Outsourced accounting services encompass a wide range of tasks, including bookkeeping, financial statement preparation, tax reporting, payroll processing, and more. By outsourcing these functions, banks can streamline their operations, enhance accuracy, and ensure compliance with regulatory requirements.

Key accounting functions outsourced by banks

1. Bookkeeping:

Bookkeeping is a fundamental accounting function that involves recording financial transactions, maintaining ledgers, and reconciling accounts. Outsourcing bookkeeping tasks allows banks to ensure accurate and timely recording of transactions, leading to improved financial transparency and decision-making.

2. Financial statement preparation and reporting:

Preparing financial statements, such as balance sheets, income statements, and cash flow statements, is crucial for banks to assess their financial performance and communicate with stakeholders. Outsourced accounting firms specialize in preparing accurate and comprehensive financial reports that adhere to regulatory standards.

3. Accounts receivable/payable management:

Managing accounts receivable and payable is essential for maintaining healthy cash flow and ensuring timely payments. Outsourcing accounts receivable/payable management tasks can help banks optimize their cash flow, reduce the risk of late payments, and improve overall financial efficiency.

5. Cost accounting:

Cost accounting involves analyzing and determining the actual costs of producing goods or services. Outsourced cost accountants collaborate with banks to develop cost-effective pricing strategies and optimize operational efficiency.

6. Financial planning and analysis:

Outsourced financial planning and analysis services help banks evaluate their financial performance, develop management reports, and make data-driven decisions. These services provide banks with valuable insights into their financial health and future growth opportunities.

7. Tax reporting and filing:

Outsourced accounting firms specialize in tax reporting and filing services, ensuring banks remain compliant with tax laws and regulations. These firms prepare and file accurate tax returns on behalf of banks, minimizing the risk of tax-related penalties.

8. Payroll processing:

Outsourced payroll processing services handle payroll administration, including calculating wages, processing employee payments, and ensuring compliance with payroll regulations. By outsourcing payroll processing, banks can streamline their payroll operations and reduce administrative burden.

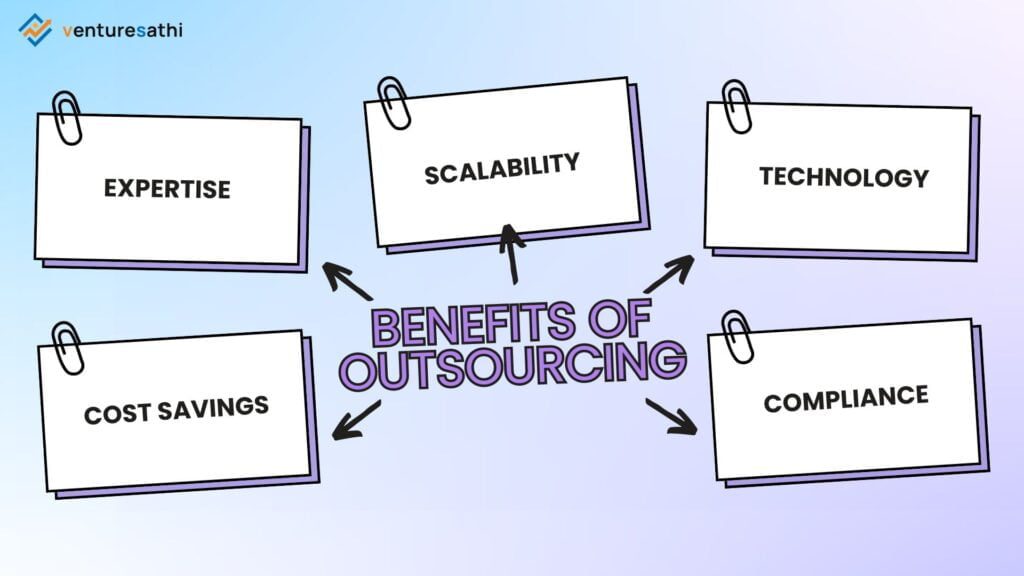

Benefits of outsourcing accounting services for banks

Cost savings: Outsourced accounting services eliminate the need for hiring and training in-house accounting staff, reducing overhead costs associated with salaries, benefits, and equipment. According to a survey conducted by the Society for Human Resource Management (SHRM), the average cost-per-hire for a new employee is around $4,129. Outsourcing eliminates these recruitment costs.

Expertise: Outsourced accounting firms provide access to specialized expertise and experienced professionals who ensure accurate and compliant financial management. A study by Deloitte found that 47% of organizations outsource to gain access to specialized skills.

Scalability: Outsourced accounting services can be scaled up or down according to the bank’s needs, providing flexibility and cost-effective solutions. In a survey by Statista, 59% of businesses mentioned scalability as a significant factor in their decision to outsource.

Technology: Outsourced accounting firms invest in advanced accounting software and technology, ensuring banks have access to the latest tools and resources. A survey by PwC found that 56% of organizations outsource to gain access to cutting-edge technology they may not afford or maintain in-house.

Compliance: Outsourced accounting firms stay updated on regulatory requirements and ensure banks remain compliant with accounting standards and regulations. The Outsourcing Institute reports that 80% of organizations outsource to improve compliance, risk management, and regulatory adherence.

Discover the transformative potential of back-office outsourcing in our blog: ” Maximizing Efficiency: The Benefits of Back Office Outsourcing “.

The Need for Outsourcing Accounting Services in the Banking Industry

Challenges faced by banks in managing accounting functions in-house:

Banks encounter various challenges when managing accounting functions in-house, including the complexity of financial transactions, the need for specialized expertise, and the burden of maintaining accurate and compliant records. In-house accounting teams may struggle to keep pace with the volume and complexity of banking operations, leading to errors, inefficiencies, and compliance risks.

Increasing regulatory requirements and compliance burdens:

The banking industry is subject to stringent regulatory requirements and compliance standards, which continue to evolve and become more complex over time. Banks must adhere to a myriad of regulations, including anti-money laundering (AML) laws, Know Your Customer (KYC) regulations, Basel III requirements, and more. Managing these compliance obligations in-house requires significant resources and expertise, making outsourcing accounting services an attractive option for banks seeking to mitigate compliance risks. A survey conducted by Deloitte found that 74% of banking executives consider regulatory compliance as one of their top challenges.

Complexities of modern banking operations and the need for specialized accounting expertise:

Modern banking operations involve a wide range of complex financial transactions, including lending, investments, foreign exchange, and derivatives. These transactions require specialized accounting expertise to ensure accurate recording, reporting, and analysis. Outsourced accounting firms specialize in banking accounting and possess the necessary skills and experience to handle the complexities of modern banking operations effectively. According to a survey by EY, 62% of financial services organizations believe that a lack of skilled resources is a major challenge in managing financial and regulatory reporting.

Cost-effectiveness and efficiency of outsourcing accounting services for banks:

Outsourcing accounting services offers banks a cost-effective solution for managing their accounting functions. By outsourcing, banks can avoid the costs associated with hiring and training in-house accounting staff, as well as the expenses of maintaining accounting software and infrastructure. Outsourced accounting firms typically offer flexible pricing models, allowing banks to pay only for the services they need, when they need them. Additionally, outsourcing accounting services can improve operational efficiency by streamlining processes and reducing administrative burdens. The Outsourcing Institute states that outsourcing can reduce operational costs by 15-30%, contributing to overall cost-effectiveness.

Role of outsourced accounting in enhancing data security and confidentiality:

Data security and confidentiality are paramount concerns for banks, given the sensitive nature of financial information. Outsourced accounting firms employ advanced security measures and protocols to safeguard clients’ data against unauthorized access, breaches, and cyber threats. These firms adhere to industry best practices and regulatory requirements to ensure the highest standards of data security and confidentiality. By outsourcing accounting services, banks can enhance their data security posture and minimize the risk of data breaches and compliance violations. According to Statista, 42% of organizations outsource to improve their cybersecurity and data protection measures.

Navigate the intricacies of banking operations with seamless accuracy through outsourced accounting. Explore ‘ Choosing the Right Back Office Outsourcing Partner: Key Considerations ‘.

Considerations for Banks When Outsourcing Accounting Services

A. Choosing the right outsourcing partner:

Selecting the right outsourcing partner is crucial for banks seeking to outsource their accounting services. Banks should carefully evaluate potential outsourcing firms based on their expertise, reputation, record of accomplishment, and industry experience. It is essential to choose a partner with a proven record of accomplishment in delivering high-quality accounting services to banking clients. Additionally, banks should consider factors such as the outsourcing firm’s technology capabilities, communication protocols, and responsiveness to client needs. By choosing the right outsourcing partner, banks can ensure a successful and mutually beneficial partnership.

B. Ensuring data security and confidentiality:

Data security and confidentiality are paramount concerns for banks when outsourcing accounting services. Banks deal with sensitive financial information, and any breach of data security could have severe consequences. Therefore, banks should thoroughly assess the data security measures and protocols implemented by potential outsourcing partners. Outsourcing firms should adhere to industry best practices and regulatory requirements for data security, including encryption, access controls, and regular security audits. By ensuring robust data security measures, banks can protect their confidential information and mitigate the risk of data breaches.

C. Compliance with regulatory requirements and industry standards:

Compliance with regulatory requirements and industry standards is essential for banks outsourcing their accounting services. Banks operate in a highly regulated environment and must comply with various financial regulations and reporting standards. Therefore, banks should choose an outsourcing partner with a deep understanding of banking regulations and compliance requirements. Outsourcing firms should have experience working with banks and be familiar with relevant regulatory frameworks, such as Basel III, Dodd-Frank, and Sarbanes-Oxley. By partnering with a compliant outsourcing firm, banks can ensure adherence to regulatory requirements and avoid potential compliance issues.

D. Evaluating the cost-effectiveness of outsourcing vs. in-house accounting:

Banks should carefully evaluate the cost-effectiveness of outsourcing accounting services compared to maintaining an in-house accounting team. Outsourcing accounting services can offer significant cost savings for banks by eliminating the need for hiring and training in-house staff, as well as reducing overhead costs associated with maintaining accounting software and infrastructure. Additionally, outsourcing firms typically offer flexible pricing models that allow banks to pay only for the services they need when they need them. Banks should conduct a cost-benefit analysis to determine the financial impact of outsourcing accounting services and compare it to the costs of in-house accounting. By evaluating the cost-effectiveness of outsourcing, banks can make informed decisions that align with their financial objectives.

E. Assessing the scalability and flexibility of outsourced accounting solutions:

Scalability and flexibility are essential considerations for banks when outsourcing their accounting services. Banks’ accounting needs may vary depending on factors such as business growth, regulatory changes, and market conditions. Therefore, banks should choose an outsourcing partner that offers scalable and flexible accounting solutions to accommodate their evolving needs. Outsourcing firms should be able to adjust their services and resources to meet banks’ changing requirements quickly. Additionally, banks should assess the outsourcing firm’s ability to scale up or down its services as needed and its flexibility in accommodating custom requirements. By selecting a scalable and flexible outsourcing partner, banks can ensure that their accounting needs are effectively met, both now and in the future.

Unleash the power of effective back-office management – discover how it can boost your bank’s bottom line! Read our blog, ” Boost Your Bottom Line with Effective Back Office Management,”.

Conclusion

Looking ahead, the future of outsourcing accounting in banking appears promising. As regulatory requirements continue to evolve, technological advancements reshape the industry, and competitive pressures intensify, banks will increasingly rely on external partners to achieve operational efficiency, ensure compliance, and drive sustainable growth. Outsourcing firms are poised to play a crucial role in this equation, investing in advanced technologies and attracting top talent to deliver innovative and secure solutions tailored to the unique needs of the banking industry.

In conclusion, outsourcing accounting services offers a strategic approach for banks to optimize operations, leverage specialized expertise, and enhance their compliance frameworks. By carefully selecting a reputable partner, banks can unlock significant benefits and gain a competitive edge in today’s dynamic and demanding financial landscape.

Unlock the transformative potential of outsourced accounting for your bank. Partner with Venturesathi and embark on a journey towards streamlined operations, unwavering compliance, and sustainable growth.

“Insightful article! These six factors provide a clear roadmap for selecting the right outsourced bookkeeping partner. Thanks for sharing such valuable guidance!”

These are truly enormous ideas in concerning

blogging. You have touched some good things here.

Any way keep up wrinting.