Introduction:

Contact centers play a crucial role in the banking sector as they serve as the primary interface for customers to engage with financial institutions for services, inquiries, and support. With banking transactions increasingly shifting towards digital channels, contact centers are vital for addressing customer queries, resolving issues, and providing personalized assistance. They also ensure regulatory compliance and security standards, safeguarding customer data and upholding trust and credibility.

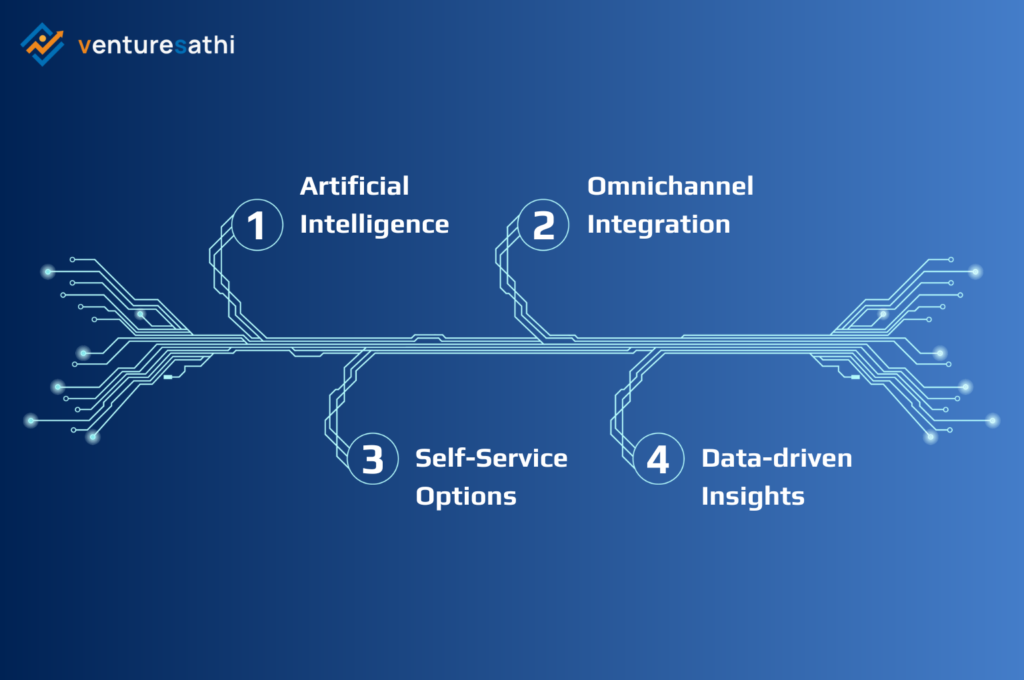

The evolution of contact center solutions in the banking sector mirrors technological advancements and customer preferences. Traditional telephony systems have been replaced by omnichannel communication, integrating email, live chat, social media, and mobile apps. Advanced technologies like AI, machine learning, and natural language processing have revolutionized contact center operations, enhanced efficiency, and reduced operational costs.

Ready to revolutionize your banking contact center with cutting-edge solutions? Explore how Venturesathi can elevate your customer experience while ensuring compliance and security.

The Role of Contact Centers in the Financial Industry

A. Importance of Customer Service:

In the financial industry, providing exceptional customer service is paramount for building trust and loyalty among clients. With numerous options available, customers expect personalized assistance and quick resolutions to their queries or concerns. Contact centers serve as the frontline for delivering this level of service, ensuring that customers feel valued and supported throughout their interactions. According to a survey by PwC, 73% of customers consider customer experience a crucial factor in their purchasing decisions within the financial industry.

B. Addressing Challenges Faced by Financial Institutions:

Financial institutions encounter various challenges in today’s competitive landscape. Factors such as increased competition, frequent mergers, and the emergence of neo-banks add complexity to the industry. To stay competitive and relevant, banks and other financial entities rely on contact centers to efficiently address customer needs, adapt to market changes, and maintain a strong presence in the industry. A report by McKinsey states that 79% of banking executives see increased competition as a significant challenge in the financial industry.

C. Cost-Effectiveness and Efficiency:

Despite the challenges, contact centers offer a cost-effective and efficient solution for meeting customer demands. By centralizing customer interactions and leveraging technology, financial institutions can streamline communication processes, reduce operational costs, and provide timely support to their clients. This efficiency translates into enhanced customer satisfaction and ultimately contributes to the institution’s success in the market. A study by ContactBabel found that contact centers can reduce operational costs by up to 40%, making them a cost-effective solution for financial institutions.

Benefits of Contact Center Solutions for Banking

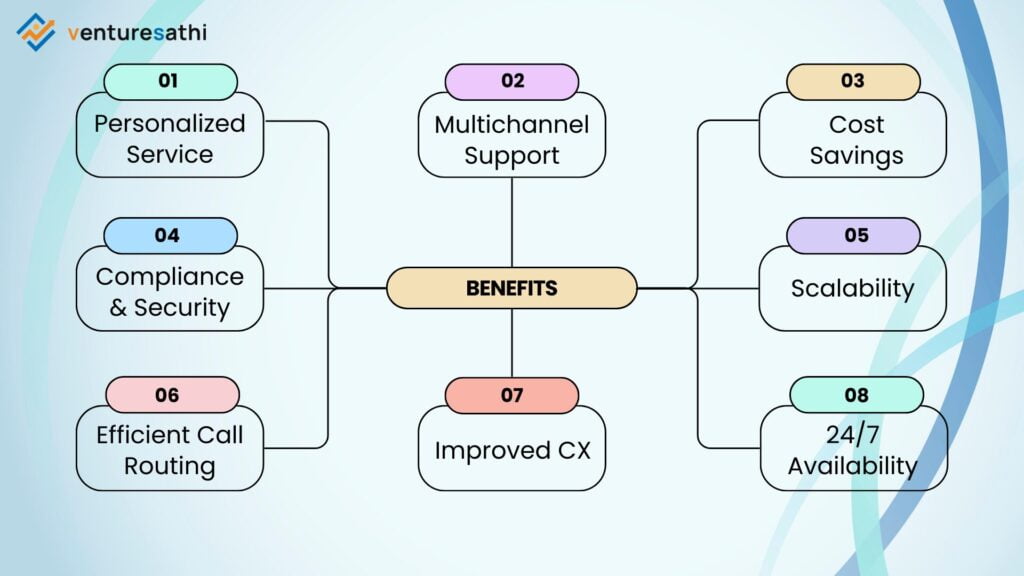

Contact center solutions offer numerous benefits for banking institutions, enhancing customer service, operational efficiency, and overall business performance. Some key benefits include:

- Personalized Service: Contact center solutions often integrate with customer relationship management (CRM) systems, allowing agents to access customer information quickly. This enables personalized interactions where agents can address customers by name and offer tailored solutions based on their history and preferences. EConsultancy reports that 74% of marketers say targeted personalization increases customer engagement.

- Multichannel Support: Modern contact center solutions support multiple communication channels, including voice, email, chat, SMS, and social media. This versatility enables customers to choose their preferred mode of communication, enhancing convenience and accessibility. report by Aberdeen Group states that companies with strong omnichannel customer engagement see a 9.5% year-over-year increase in annual revenue, compared to 3.4% for weak omnichannel companies.

- Cost Savings: Contact center solutions optimize resource utilization by efficiently managing call volumes, staffing levels, and agent productivity. This leads to cost savings through reduced operational expenses and improved workforce efficiency. According to Gartner, businesses that invest in customer experience see a 50% higher customer lifetime value than those that don’t.

- Compliance and Security: Contact center solutions incorporate security measures to ensure compliance with regulatory requirements such as PCI DSS (Payment Card Industry Data Security Standard) for handling sensitive financial information. Built-in security features protect customer data, transactions, and communications, fostering trust and confidence among banking customers. The Ponemon Institute’s Cost of Cyber-Crime Study found that the average cost of a data breach is $3.86 million.

- Scalability: Contact center solutions offer scalability to accommodate fluctuating call volumes and business growth. Banks can easily scale up or down their contact center operations by adding or removing agents, expanding communication channels, and adapting to evolving customer demands. Deloitte’s Global Contact Center Survey shows that 82% of contact centers view scalability as a priority for future technology investments.

- Efficient Call Routing: Advanced call routing features ensure that customer calls are directed to the most appropriate agent or department, reducing wait times, and improving first-call resolution rates. Intelligent routing based on factors like customer history, language preference, and issue complexity enhances efficiency and customer satisfaction. A study by Salesforce indicates that 75% of customers expect a consistent experience regardless of the channel they use.

- Improved Customer Experience: Contact center solutions streamline communication channels, enabling customers to reach their banks through various mediums such as phone, email, chat, and social media. This accessibility improves customer satisfaction by providing timely assistance and resolutions to their queries and concerns. According to a study by Bain & Company, increasing customer retention rates by 5% can increase profits by 25% to 95%.

- 24/7 Availability: Contact centers enable round-the-clock customer support, ensuring that banking services are available to customers anytime, anywhere. This is particularly crucial for global banks serving customers across different time zones. A survey by HubSpot Research found that 90% of customers rate an “immediate” response as important or very important when they have a customer service question.

Unlock the full potential of contact center outsourcing for your banking institution! Dive deeper into our blog: ‘Benefits of Contact Center Outsourcing: Cost Savings and Beyond’

Key Features of Contact Center Software for Financial Institutions

A. Skill-Based Dialling System:

Contact center software for financial institutions incorporates a skill-based dialing system to ensure efficient call routing. This system directs customer calls to the most appropriate agents based on their expertise and specialization. For example, technical support queries are directed to agents with relevant technical skills, while inquiries regarding account management are routed to customer service representatives. By matching callers with agents who possess the necessary skills to address their specific needs, the skill-based dialing system enhances the efficiency and effectiveness of customer interactions.

B. Speech Analysis Tool:

Contact center software includes a speech analysis tool that provides valuable insights into customer behavior and preferences. This tool analyzes customer tone, sentiment, and language, aiding financial institutions in understanding their clients better. By identifying patterns and trends in customer communication, banks can tailor their services and offerings to better meet customer needs. Additionally, the speech analysis tool enables proactive engagement and personalized assistance, enhancing the overall customer experience and satisfaction.

C. Cloud-Based Technology:

Contact center software utilizes cloud-based technology, offering scalability and cost-effectiveness for financial institutions. Cloud-based solutions provide flexibility and scalability to accommodate fluctuating call volumes and business demands. Financial institutions can easily scale their contact center operations up or down based on seasonal peaks, promotional campaigns, or other factors. Moreover, cloud-based technology eliminates the need for costly on-premises infrastructure and maintenance, resulting in significant cost savings for banks. By leveraging cloud-based contact center software, financial institutions can optimize resource allocation and enhance operational efficiency.

Stay ahead of the curve with the latest advancements in contact center technology. Learn how technology is reshaping modern contact center outsourcing in our blog: ‘Technology’s Role in Modern Contact Center Outsourcing‘.

Security Considerations in Implementing Contact Center Software in Finance

Implementing contact center software in finance necessitates stringent security measures, including robust data encryption and restricted access to sensitive information. Data encryption guarantees the security of customer data during transmission and storage while limiting access to sensitive data to authorized personnel to prevent unauthorized entry and potential data breaches. Prioritizing data encryption and access control ensures customer confidentiality and adherence to regulatory standards. Financial institutions must comply with global regulatory and compliance requirements, encompassing data privacy, security standards, and consumer protection laws. By maintaining compliance, financial institutions can mitigate legal risks and uphold their reputation as trustworthy organizations.

Mitigating fraud and cyberattacks is paramount for financial institutions, given their attractiveness to cyber criminals. Implementing robust security protocols such as multi-factor authentication, intrusion detection systems, and real-time monitoring aids in identifying and preventing unauthorized access and fraudulent activities. Emphasizing security measures enhances data protection and sustains customer trust in contact center operations.

Discover more insights on emerging technological trends in contact centers and how they can enhance your banking services by reading our blog: ‘Emerging Technological Trends in Contact Centers’

Enhancing Customer Engagement with Contact Center Technology

Contact center technology plays a pivotal role in augmenting customer engagement by reducing wait times and offering self-service options. Leveraging AI and machine learning capabilities, it delivers personalized financial advice based on customer interactions and historical transactions, thereby catering to individual needs and preferences, and enriching the overall customer experience. Furthermore, contact center technology empowers call center agents through training and feedback mechanisms, nurturing customer satisfaction. By investing in the professional development of call center agents, financial institutions ensure compliance and customer contentment, ultimately contributing to heightened customer engagement and loyalty. In essence, contact center technology emerges as a critical enabler in bolstering customer engagement.

Conclusion

Contact centers serve as the frontline for customer interactions in banks, playing an indispensable role in ensuring trust, efficiency, and global accessibility in banking services. As technology advances, contact centers evolve to deliver personalized service, meeting dynamic banking industry expectations.

The future of contact center solutions in banking looks promising, driven by technology advancements and a focus on customer experience. Contact centers will continue to play a crucial role in meeting evolving needs and fostering success in banking.

Ready to embrace the future of banking contact centers? Partner with Venturesathi to leverage advanced solutions and stay ahead in the dynamic banking landscape.

I’ve learned a lot about email marketing metrics from your blog.