Do You Think Your Contact Centre Strategy Is Working?

Most business leaders believe their contact centre strategy is working.

Calls are answered. SLAs are met. Dashboards look green.

Yet customer complaints rise, agents leave faster than expected, and CX outcomes refuse to improve.

This raises a critical question:

Is your contact centre strategy actually working – or is it simply operationally active?

In this blog, we break down how to objectively evaluate your contact centre strategy by looking beyond speed and volume metrics, identify common failure patterns, and clarify what a truly effective contact centre strategy looks like in practice.

Why Evaluating Your Contact Centre Strategy Matters More Than Ever

Contact centres are no longer just support functions.

They sit at the intersection of customer experience, brand perception, cost efficiency, and revenue protection.

A weak strategy doesn’t just impact CX – it silently erodes:

- Customer retention

- Agent productivity

- Operating margins

- Leadership confidence in CX data

Yet many organisations continue to evaluate contact centres using outdated or incomplete metrics.

Why Most Contact Centre Strategies Appear to Be “Working”

The issue is how success is defined.

Most leaders track operational activity rather than strategic effectiveness. As a result, the contact centre appears healthy—even when experience and outcomes are deteriorating.

Common Evaluation Criteria (And Their Blind Spots)

| Evaluation Area | What Leaders Track | What It Misses |

|---|---|---|

| Call Volumes | Calls handled, tickets closed | Resolution quality |

| Cost Metrics | Cost per call | Downstream churn & repeats |

| SLAs | ASA, AHT | Customer effort |

| Staffing | Seats filled, shifts covered | Capability & morale |

| Technology | Tools deployed | Adoption & impact |

These metrics tell you whether the machine is running, not whether it is delivering value.

Common Symptoms of a Failing Contact Centre Strategy

Leaders rarely search for “contact centre strategy failure.” They experience symptoms instead.

You may recognise these warning signs:

- CSAT declines despite SLA compliance

- Repeat contacts increase while AHT improves

- Agent attrition rises despite incentives

- AI or CRM investments fail to show ROI

- CX dashboards look positive, but customer trust weakens

When these symptoms appear together, the issue is almost never tactical. It is strategic.

How to Evaluate Your Contact Centre Strategy: A 5-Minute Diagnostic

Answer these honestly.

If more than two answers are unclear, your strategy needs attention.

| Question | What It Reveals |

|---|---|

| Do you clearly know why customers contact you? | Customer intent clarity |

| Is first-call resolution consistent across agents? | Process maturity |

| Do fast agents also have high CSAT? | Metric balance |

| Are your best agents also your longest-tenured ones? | Talent health |

| Can you predict demand spikes in advance? | Workforce intelligence |

| Does CX data influence business decisions? | Strategic integration |

A contact centre without these answers is reacting – not strategizing.

Strategy vs Operations: A Critical Distinction for Contact Centres

One of the most common problems is the confusion between operations and strategy.

| Area | Operational Focus | Strategic Focus |

|---|---|---|

| Staffing | Fill shifts | Design workforce |

| Metrics | Track speed | Optimise outcomes |

| Technology | Deploy tools | Enable experience |

| Training | Onboarding | Continuous capability |

| Cost Control | Reduce spend | Improve ROI |

Operations keep the lights on.

Strategy ensures the lights are worth keeping on.

4 Repeating Failure Patterns in Contact Centre Strategies

Across industries and company sizes, the same issues surface repeatedly.

1. Cost-First Strategy

“Let’s reduce cost per call.”

What happens:

- Aggressive AHT targets

- Agent burnout

- Repeat calls increase

Lower cost per call often results in higher cost per customer.

2. Tool-First Thinking

“We need a better CRM, dialer, or AI solution.”

What happens:

- Tools underutilised

- No behaviour change

- CX outcomes unchanged

Technology amplifies design—it does not replace it.

3. Metrics Without Meaning

“Our SLAs are green, so we’re doing fine.”

What happens:

- Agents optimise for metrics, not customers

- Supervisors manage dashboards, not outcomes

- Customers still feel unheard

Metrics should drive better decisions, not just reporting.

4. Treating Agents as Replaceable

“Attrition is normal in contact centres.”

What happens:

- Knowledge drain

- Rising training costs

- Inconsistent CX

High attrition is not a people problem – it is a system design problem.

What a Working Contact Centre Strategy Actually Looks Like

A strong contact centre strategy aligns customer intent, operations, people, and technology into a single system.

Rather than optimising individual metrics, leaders focus on end-to-end outcomes:

- Clear understanding of why customers contact the organisation

- Workforce planning driven by demand patterns, not averages

- Resolution effectiveness balanced with speed

- CX insights embedded into business decisions

- Technology that enables behaviour change, not just reporting

Key Strategic Layers

| Evaluation Area | What Leaders Track | What It Misses |

|---|---|---|

| Call Volumes | Calls handled, tickets closed | Resolution quality |

| Cost Metrics | Cost per call | Downstream churn & repeats |

| SLAs | ASA, AHT | Customer effort |

| Staffing | Seats filled, shifts covered | Capability & morale |

| Technology | Tools deployed | Adoption & impact |

When one layer fails, the entire experience weakens.

A Practical 5-Minute Self-Assessment

Score each area honestly (1 = Weak, 5 = Strong).

| Dimension | Score |

|---|---|

| Customer intent clarity | |

| Workforce planning accuracy | |

| Resolution effectiveness | |

| Quality & CSAT alignment | |

| Use of CX insights in decisions |

How to Interpret Your Score

| Total Score | Meaning |

|---|---|

| 20–25 | Strategy is working |

| 12–19 | Strategy exists, execution weak |

| Below 12 | Operations exist, strategy does not |

This simple exercise often reveals more than months of reporting.

The Strategic Shift Most Leaders Need to Make

| From | To |

|---|---|

| Contact centre as cost | Contact centre as CX engine |

| Speed as success | Resolution as success |

| Tools as solution | Design as solution |

| Monitoring agents | Enabling agents |

| Firefighting | Predictive operations |

This shift changes not just CX, but leadership confidence.

When Organisations Usually Seek External Support

Leaders typically ask for help when:

- CSAT declines despite SLA compliance

- Scaling breaks consistency

- Attrition rises despite incentives

- AI investments fail to show ROI

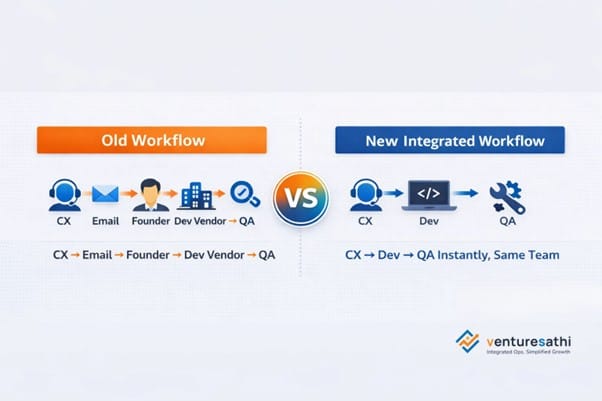

In most cases, the issue is not one missing element, but a lack of integrated design across people, process, and technology.

Final Thought: Is Your Contact Centre Strategy Really Working?

A contact centre strategy is not working

just because calls are answered and SLAs are met.

It is working only when customers trust the interaction, agents believe in the system, and leadership uses CX insight as a decision engine.

If you’re unsure whether your strategy is working, that uncertainty itself is the most valuable signal.