KYC, Reconciliation & Fraud Monitoring

Why BFSI Needs Specialized Ops, Not Generic Agents

In the BFSI world, operational errors are not small administrative slipups, they are often the spark that triggers financial loss, customer churn, and compliance penalties. A mismatched reconciliation entry, a misjudged KYC verification, or a missed fraud alert can cause cascading damage.

PwC’s Global Economic Crime Survey 2024 reports that 55% of global companies identified operational fraud as a major risk, highlighting the need for specialized operations beyond generic call-center agents. This is why specialized BFSI operations are no longer “nice to have.” Moreover, the rise of fintech, digital lending, and real-time payments has made skilled BFSI outsourcing services, KYC outsourcing services, and fraud monitoring outsourcing essential to building compliance-first, scalable organisations.

Why BFSI Ops are Fundamentally Different

Unlike traditional support or back-office work, BFSI operations sit at the crossroads of compliance, finance, and customer trust. Every action taken by an operations team interacts with FRS guidelines, AML norms, data privacy standards like GDPR, and sector-specific mandates such as PCI DSS. The margin for error is extremely narrow because even a single oversight can jeopardize audits, block customer accounts, or create a chain reaction of failed reconciliations.

Most importantly, BFSI teams handle large volumes of sensitive financial data. These workflows require structured validation, judgement-based decision-making, and strong regulatory understanding. It is not a domain where templated scripts or generic BPO training can ensure accuracy. That is why companies that invest in specialized fintech back-office operations consistently outperform those that rely on generalist agents.

The Hidden Risks of Using Generic Agents

Many fintech and BFSI founders initially assume that basic back-office tasks can be handled by any trained BPO team. But this assumption tends to unravel quickly as soon as KYC accuracy drops or reconciliation mismatches start piling up. The reality is that generic agents simply do not possess the financial and regulatory literacy required for compliance-heavy workflows.

strategic work aside.

Here’s how:

Higher KYC Failure Rates

KYC is often treated as a “basic verification step,” but in reality, it is the foundation of customer onboarding. When generic agents handle KYC mismatched IDs go unchecked, expiry dates go unnoticed, low-quality documents get approved and risk flags get ignored.

This results in account blocking, compliance violations, and audit escalations.

Reconciliation Errors Cost Millions

Reconciliation is even more unforgiving. PwC reports that 32% of fintech disputes emerge from reconciliation errors alone. A generic agent might fail to match payment gateway settlements properly, overlook ledger discrepancies, or mishandle a refund cycle. Each mismatch impacts reporting accuracy and cash flow visibility, which affects financial planning and investor confidence.

Fraud Detection Delays

Fraud monitoring, one of the most critical functions, cannot be handled by someone who only knows how to follow a script. Fraud analysts require the ability to interpret transaction patterns, identify behavioural anomalies, and act quickly during suspicious spikes. When generic agents manage fraud operations, the consequences are immediate resulting in increased chargebacks, higher false positives, and massive financial losses.

Why Specialized Ops Improve KYC, Reconciliation & Fraud Monitoring

Specialized BFSI outsourcing services go far beyond basic back-office processes. They integrate compliance expertise, domain training, risk frameworks, and automation tools into daily operations. Here’s how:

Specialized KYC Handling

Specialized KYC outsourcing services provide structured verification rather than checkbox processing. Analysts understand how to validate complex document types, conduct accurate facial matching, flag PEP/AML risks, and manage exceptions without disrupting customer onboarding. This dramatically increases pass rates while reducing regulatory escalations.

Accurate Reconciliation

In reconciliation, experts working within dedicated reconciliation outsourcing services ensure fast and accurate matching across payment gateways, bank statements, ledger entries, and settlements. Their ability to identify discrepancies early prevents revenue leakage and enables financial accuracy at scale.

Real-Time Fraud Monitoring

Fraud detection requires a unique blend of analytical judgement and speed. Teams trained in fraud monitoring outsourcing evaluate identity mismatches, velocity spikes, device behaviour anomalies, and transaction patterns in real time. These analysts understand risk scoring and escalation protocols, and can reduce both fraud losses and false alarms while enabling the business to maintain a trust-first customer experience.

Financial operations demand precision. Generic agents simply aren’t equipped for compliance-heavy workflows.

Deep Dive Into BFSI Workflows

To understand why specialized BFSI operations matter, it helps to look at how these workflows function in practice. KYC goes far beyond basic document collection, it includes video KYC, identity validation, AML checks, and exception handling. Accuracy here directly affects onboarding success rates and compliance readiness.

Reconciliation is a daily financial backbone that ensures that deposits, withdrawals, gateway settlements, and refunds perfectly match internal ledgers. When reconciliation is managed by trained analysts working within structured fintech back-office operations, financial reporting becomes significantly cleaner and more reliable.

Fraud monitoring is a continuous, living system. It involves tracking unusual behaviour patterns, monitoring suspicious transactions, and responding instantly to anomalies. With expert oversight, businesses can build a proactive fraud prevention layer instead of merely reacting to losses.

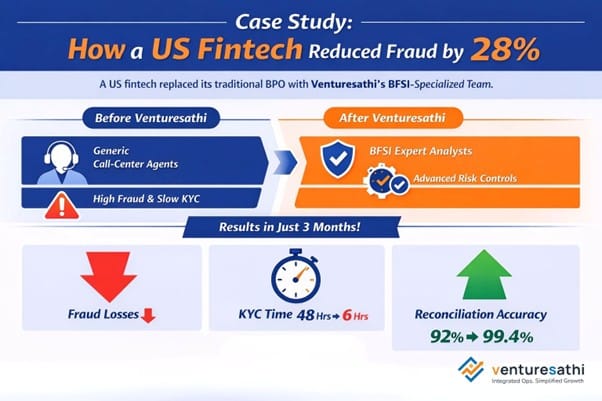

Case Study: How a US-based Fintech Company Reduced Fraud by 28%

A growing US fintech company recently replaced its traditional BPO with Venturesathi’s BFSI-specialized operations team. Within three months, their operational metrics transformed.

Fraud losses dropped by 28% owing to better rule-based monitoring and faster anomaly detection. Their KYC turnaround time fell from 48 hours to just 6 hours, reducing onboarding friction and customer drop-offs. Reconciliation accuracy increased from 92% to a whopping industry-leading 99.4%, eliminating the financial blind spots they had been struggling with for months.

Read more: Driving Digital Efficiency for a Leading NBFC with Salesforce

How to Build a BFSI Ops Framework That Actually Scales

Building a reliable operations engine is one of the biggest challenges for fast-growing fintechs and BFSI companies. High-stakes workflows like KYC, reconciliation, and fraud monitoring require a systematic, compliance-ready framework.

Here’s how a strong BFSI operations foundation should be designed.

Role-Based Hiring: The Backbone of Strong BFSI Outsourcing Services

A scalable BFSI ops function starts with hiring specialists trained to handle regulated processes. Instead of general support agents, fintechs need dedicated:

A scalable BFSI ops function starts with hiring specialists trained to handle regulated processes. Instead of general support agents, fintechs need dedicated:

- KYC Analysts: They are professionals trained in document verification, video KYC, risk scoring, and AML flags. Can be achieved through high-quality KYC outsourcing services.

- Fraud Monitoring Specialists: These are experts who understand behavioural anomalies, velocity checks, and transaction-pattern deviations. Thanks to fraud monitoring outsourcing services.

- Reconciliation Analysts: These analysts track payment gateways, ledgers, and settlements with precision, thus strengthening your reconciliation.

- QA & Compliance Leads: They ensure every workflow meets regulatory expectations and is audit-ready at all times.

Workflow Design for Turning Processes Into Predictable, Error-Proof Systems

Even the best BFSI team underperforms without a strong workflow structure. High-risk processes like KYC and fraud require:

- Standard Operating Procedures (SOPs): Includes documentation with clear, step-by-step protocols to eliminate variations in handling.

- Escalation Maps: These include defined paths for raising compliance concerns or suspicious cases immediately.

- Exception Logs: These help in tracking and reviewing unusual document, mismatch, or flagged transactions.

- Maker-Checker Layers: A mandatory control for BFSI operations to maintain accuracy and reduce fraud risks.

- Complete Audit Trails: This is important to satisfy regulatory audits and maintain transparency with compliance teams

Training & Certification: The Lifeblood of High-Quality Fintech Back-Office Operations

Fintech and BFSI workflows evolve rapidly, which means teams must stay aligned with regulatory and fraud-risk changes. Strong training programs cover:

- KYC norms across jurisdictions that align with US, EU, and APAC verification requirements.

- AML, PEP, and sanctions monitoring that help analysts identify suspicious entities early.

- Regulatory frameworks for understanding compliance obligations such as GDPR, PCI DSS norms.

- Fraud pattern indicator for recognizing early-stage fraud signals and behavioural anomalies.

This structured approach is what separates operational chaos from operational excellence. Fintechs that invest early in domain-trained analysts, compliant workflows, and strong fraud-monitoring systems consistently outperform those relying on generic BPO teams. When your operations truly understand regulatory stakes, error rates drop, customer trust rises, and growth becomes more predictable.

Bottom Line

The BFSI ecosystem is unforgiving to operational errors. Compliance, accuracy, and trust form the foundation of every customer interaction and these demands cannot be met by generic BPO teams. Specialized BFSI outsourcing services, KYC outsourcing services, fraud monitoring outsourcing, and structured reconciliation outsourcing services give fintech and BFSI companies the precision and stability they need to grow responsibly.

FAQs

Fintech workflows like KYC, reconciliation, and fraud monitoring require trained analysts, not generic agents. BFSI outsourcing services ensure accuracy, compliance, and lower operational risk.

KYC outsourcing services use trained analysts and structured verification processes to reduce errors, speed up approvals, and ensure compliance with AML and regulatory guidelines.

Fraud monitoring outsourcing provides 24×7 oversight, expert review, and faster anomaly detection, something generic agents and small in-house teams cannot consistently deliver.

Reconciliation outsourcing services reduce mismatches, improve settlement accuracy, and create cleaner financial reporting, making fintech back-office operations more reliable and audit-ready.

If you experience slow KYC processing, recurring reconciliation errors, or rising fraud alerts, it’s time to shift from generic agents to specialized BFSI operations for stronger accuracy and compliance.