How to Extend Your Startup Runway by 4–6 Months Through Integrated Ops

For most early-stage and growth-stage founders, the question isn’t “How do we scale?”

It’s “How do we survive long enough to scale?”

Every month of burn matters. Every mis-hire compounds. Every inefficiency across operations, whether customer support, engineering ops, finance workflows, or QA directly cuts into your cash runway. And in today’s funding climate, extending your startup runway by even 4–6 months can be the difference between a bridge round and a shutdown.

The good news? You don’t always need a fresh fundraise. You can extend your startup runway simply by reducing burn rate through smarter, integrated operations. This is where integrated ops, supported by strategic outsourcing, becomes a powerful lever for outsourcing savings, operational efficiency, and long-term sustainability.

Why Startups Need to Take Runway Extension Seriously

According to a report by J.P. Morgan, 38% of startups fail due to running out of cash or being unable to raise new capital. If your monthly burn rate is high, even a small operational shift can yield dramatic results. A startup burning $250K/month can unlock an extra 4–6 months of life simply by reducing operational costs by 20–30%.

Funding Cycles Are Slower Than Ever

With VC deployment down and due-diligence cycles getting longer, founders can no longer rely on quick top-ups. This makes startup cashflow management a priority, not a nice-to-have.

Burn Now Determines Survival Later

A startup might have a great product, strong early traction, and paying customers, but if burn rate is unmanaged, the business still collapses. Reducing burn rate through operational optimization is much easier than increasing revenue under pressure.

Operational Waste Is Often Invisible

Startup teams spend too much on things that do not directly contribute to revenue such as oversized customer support teams, redundant QA layers, manual reconciliation or reporting, developer time wasted on non-engineering tasks, fragmented vendor contracts and tools with overlapping features. This is where integrated ops delivers compounding value.

What Are Integrated Ops and Why Do They Cut Costs So Quickly

Integrated ops bring multiple workflows such as CX, DevOps, QA, finance ops, back office, compliance ops under one unified operational system. Instead of working in silos, all processes, teams, SOPs, and reporting structures come together under one coordinated structure.

Integrated Ops Reduce Burn by Eliminating Operational Fragmentation

When startups work with multiple vendors, they end up with 3 to 4 PMs managing vendors, different SLAs, inconsistent quality, increased headcount to “manage the managers”, higher billing, redundant processes, slower delivery due to handoff delays. Consolidation into one integrated operations partner delivers immediate operational cost reduction by 25–40%.

Integrated Ops Improve Productivity Per Dollar

Founders often assume that cutting costs means reducing output. However, integrated ops work differently through fewer people meaning more specialized skills, mature SOPs reducing errors, maker-checker layers ensuring quality, automated workflows reducing manual work, cross-functional visibility reducing rework, and one PM managing the entire ecosystem. This creates a dramatic improvement in productivity while still producing outsourcing impact on runway extension.

Integrated Ops Reduces Compliance & Tax Complexity Related To Multiple Vendors

When startups work with vendors scattered across different cities or countries, each partnership adds its own layer of legal compliance, invoicing formats, tax implications, and documentation requirements. This increases operational overhead and makes financial reporting harder. By shifting to an integrated ops model, startups eliminate multi-vendor compliance risks and streamline all legal and tax processes through a single partner, reducing both cost and complexity.

Read more: Do You Think Your Contact Centre Strategy Is Working?

How Exactly Can Integrated Ops Extend Your Startup Runway by 4–6 Months?

Let’s break this down systematically. The runway extension comes from three main levers.

1. Operational Cost Reduction Through Team Optimization

Most startups overstaff support teams because they expect volume spikes or seasonal surges. Integrated ops teams use demand forecasting, AI-assisted ticket triage, automated workflows, and multiskilled agents, eliminating the need for a bloated headcount.

2. Outsourcing Savings From Vendor Consolidation

Most startups unknowingly overspend due to vendor fragmentation. They have different vendors for CX, QA, engineering support, analytics, reconciliation, and DevOps assistance. Each vendor comes with their own onboarding, minimum billing, PM costs, and SLA overhead.

Consolidating vendors under one integrated ops partner saves 25–30% instantly. You can eliminate tool duplications, multiple PM layers, redundant reporting, fragmented workflows, and inefficient handovers. This creates massive outsourcing savings that flow straight back into startup cashflow management.

3. Specialized Workflows Reduce Errors

Mistakes cost startups more than salaries.Error examples that inflate burn rate include wrong refunds or chargebacks, duplicate reconciliation mismatches, compliance breaches, ticket escalations turned into churn, QA misses that lead to bugs in production,

and slow onboarding leading to revenue delays.

Integrated ops bring domain-trained specialists who reduce error rates by 40–60%. Lower errors equal lower burn and more runway for startup founders.

4. Automation and SOPs Enable Faster Delivery With Leaner Teams

Integrating ops isn’t just about people, it’s about bringing discipline into operations. Key levers include SOP libraries, maker-checker layers, automated tagging, RPA-enabled reconciliation, AI-driven QA, predictive staffing, and centralized dashboards. This reduces reliance on large manual teams and significantly cuts your burn rate.

5. Better Reporting Improves Decisions and Reduces Waste

A startup’s operational waste often comes from not knowing where the inefficiencies are. Integrated ops teams provide daily operational dashboards, forecasting, SLA compliance metrics, productivity heatmaps, and quality reports. When founders see the metrics, they make better decisions and stop burning money unnecessarily.

What Startup Functions Benefit Most from Integrated Ops

Integrated ops make the biggest impact in a few high-burn areas, directly improving operational cost reduction and startup cashflow management. The benefits include:

Customer Support & CX

Unifying CX under one partner lowers cost per ticket by 30–40%, improves CSAT, and stabilizes SLAs, all contributing to faster outsourcing savings.

Data Ops

Integrated workflows speed up data labeling, boost accuracy, and reduce headcount needs, strengthening SaaS financial optimisation.

Reconciliation and Finance Ops

Cleaner financial workflows and automated matching reduce leakages and rework, improving overall cashflow management.

and slow onboarding leading to revenue delays.

QA and Engineering Support

Consolidated QA and DevOps support reduce bugs, accelerate releases, and free engineering bandwidth, indirectly helping extend startup runway.

Across these functions, integrated ops streamline execution, reduce burn rate, and deliver measurable outsourcing impact on the runway, allowing startups to operate leaner without compromising quality.

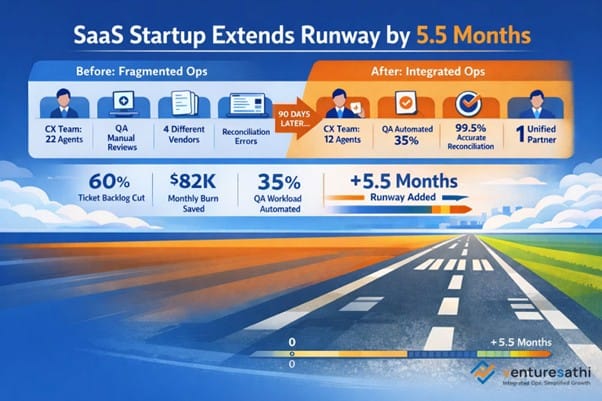

Case Study: How a SaaS Startup Added 5.5 Months of Runway with Integrated Ops

A fast-growing Series A SaaS startup came to Venturesathi with a familiar problem of rising burn, scattered vendors, and constant operational inefficiencies eating into their runway. Despite a strong product and steady revenue, their $280K/month burn rate was accelerating because core functions like CX, QA, and reconciliation were distributed across four different vendors, each with its own processes, tools, and reporting layers.

Within the first 90 days of transitioning to a fully integrated ops model, the change was dramatic.

Venturesathi streamlined the startup’s CX operations, bringing the team size down from 22 agents to 12 without compromising quality. This was achieved through better workflow design, automation, and tighter SLA governance, immediate wins that contributed to significant operational cost reduction.

On the QA side, Venturesathi automated nearly 35% of the team’s review workload, allowing the company to redeploy resources to higher-impact areas. Their reconciliation process, previously error-prone and labor-heavy, reached 99.5% accuracy, eliminating the financial mismatches that had been slowing down cashflow reporting.

Support efficiency surged as well. The ticket backlog dropped by 60% owing to unified routing and real-time triaging that replaced fragmented vendor handling. And most importantly, the startup went from four different vendors to one integrated partner, cutting out duplicated overhead, redundant management layers, and inconsistent reporting structures.

The financial impact was immediate. Monthly burn dropped by approximately $82,000, directly improving the company’s ability to extend startup runway without new funding. Their CFO summed it up perfectly:

We bought ourselves 5.5 months of runway without touching revenue or raising money. Integration paid for itself instantly.

This is exactly where integrated ops shine, helping in reducing burn rate, improving efficiency, and creating meaningful outsourcing impact on the runway.

How to Decide If Integrated Ops Can Help Your Startup

- Your burn rate is rising faster than revenue

- You have hired too quickly and too early

- You manage more than two operational vendors

- You are noticing operational errors

- Your support or QA team feels bloated

- You are struggling with cashflow visibility

- Your leadership spends too much time on operations

If this resonates, integrated ops can unlock significant operational cost reduction.

How Integrated Ops Strengthen Your Next Fundraise

A study by the Harvard Business Review found that companies that choose integrated operations are able to reduce costs and secure higher valuations. Thus, integrated ops make your startup more attractive to investors by proving you can extend your startup runway, reduce burn rate, and maintain clean, reliable reporting. When you show up with additional months of runway, streamlined vendor management, and scalable operations, you signal strong financial discipline which is a major factor in modern fundraising.

Investors consistently favour companies that demonstrate operational cost reduction, predictable processes, and a clear path to efficiently scale. By tightening workflows and improving cashflow visibility, integrated ops give you leverage at the negotiation table.

In short, extending runway isn’t just about survival, it’s a strategic advantage that directly improves your fundraising outcomes and valuation.

Key Takeaways

In a world where funding cycles are slow, competition is high, and margins are tight, the fastest way to extend your startup runway is through operational discipline, integrated workflows, and smarter outsourcing. You do not have to compromise growth to save money. You simply need to stop burning cash on fragmented, inefficient operations that do not scale.

By consolidating workflows, reducing headcount dependency, automating repetitive tasks, and centralizing accountability, your startup can reclaim 4-6 months of life, without raising another dollar. If you are serious about stretching your capital further, integrated ops is not an option, it is a survival strategy.

Frequently Asked Questions (FAQs)

Integrated ops reduce duplicated overhead, streamline workflows, and centralize CX, data, QA, and finance ops, which leads to meaningful operational cost reduction. This directly helps extend the startup runway by 4-6 months without raising additional capital.

Yes. AI call center automation reduces manual workloads, speeds up resolutions, and lowers staffing costs by automating repetitive processes.

Customer support, data ops, QA, reconciliation, and engineering assistance deliver the fastest operational cost reduction. These areas often carry duplicated roles, making them ideal for improving startup cashflow management.

For SaaS companies, integrated ops reduce headcount costs, streamline support, and eliminate process fragmentation. These efficiencies improve SaaS financial optimisation and add months of extra runway without touching revenue.

For most early-stage teams, outsourced integrated ops provide faster scalability, predictable spending, and lower burn compared to in-house hiring. This helps reduce burn rate during high-growth periods when cashflow management is critical.

Multiple vendors create communication delays, redundant overhead, and higher costs. One integrated ops partner centralizes execution, improves throughput, and unlocks outsourcing savings that directly support startup runway extension.

Absolutely. Unified workflows ensure cleaner reporting, consistent SOPs, and better financial visibility, all of which strengthen investor confidence and improve outcomes during a fundraise.

Most startups see measurable operational cost reduction within 60–90 days as duplicated roles are removed, automation increases, and processes stabilize. This rapid impact helps extend the startup runway earlier than expected.